Definition

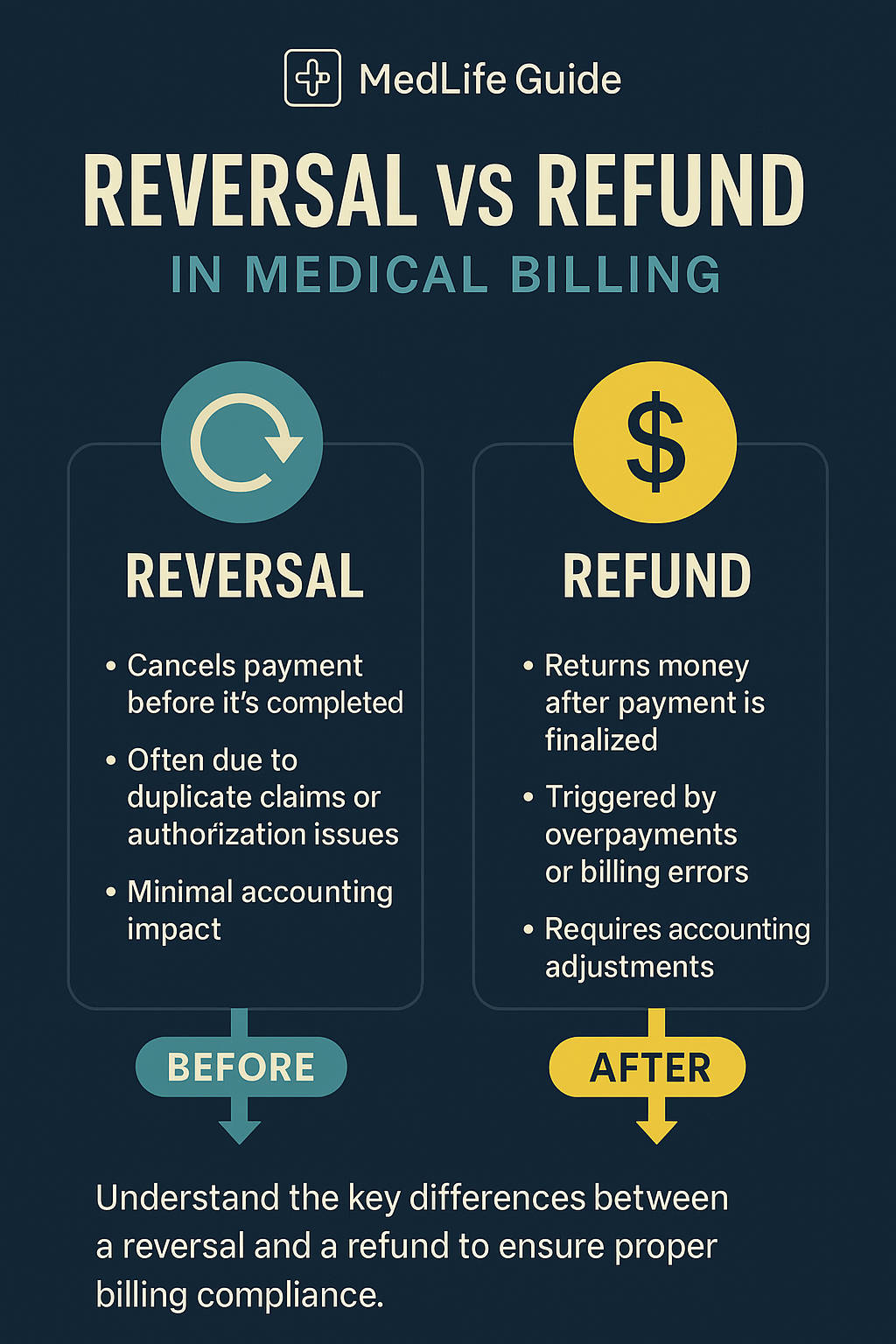

- A reversal cancels a payment before it’s completed.

- A refund returns money after a payment has been finalized.

- Knowing the difference improves accuracy, accounting records, and patient trust.

Understanding Reversals in Medical Billing

- Happens before the payment is fully processed.

- Common reasons include:

- Duplicate claims

- Incorrect patient details

- Change in authorization

- Protects accounts receivable and prevents unnecessary adjustments.

- Quick action reduces financial errors and saves time.

Understanding Refunds in Medical Billing

- Happens after the payment is finalized.

- Triggered by:

- Overpayments

- Billing errors

- Canceled or partially rendered services

- Requires formal processes, including possible appeals and adjustments.

- Affects financial audits and long-term accounting accuracy.

Quick Comparison: Reversal vs. Refund

| Aspect | Reversal | Refund |

|---|---|---|

| Timing | Before payment settles | After payment is finalized |

| Purpose | Cancel wrong/unauthorized charges | Return overpayment or correct billing errors |

| Impact on Accounting | Minimal correction needed | Requires adjustments and audit trails |

| Common Triggers | Duplicates, wrong authorization | Overbilling, service changes |

| Patient Involvement | Rarely involved | Often notified and involved |

Why the Difference Matters

- Helps in faster, cleaner financial reconciliation.

- Reduces administrative burden on billing and accounts receivable teams.

- Ensures compliance with healthcare regulations.

- Protects provider reputation and strengthens patient trust.

Best Practices for Managing Reversals and Refunds

- Train Billing Teams: Clearly define reversal vs. refund steps.

- Verify Authorization: Prevent errors before claims submission.

- Audit Billing Processes: Catch issues early and stay compliant.

- Communicate with Patients: Keep transparency around financial transactions.