Revenue Cycle Management is used in the healthcare system of the United State of America. It is useful to track the revenue for providers for the services taken by patients. It starts with a patient appointment when a patient needs any treatment or patient has any illness and ends up with the resolution of service by payment from the Insurance/Patient or Adjusted off due to a contractual agreement between the provider and the payer.

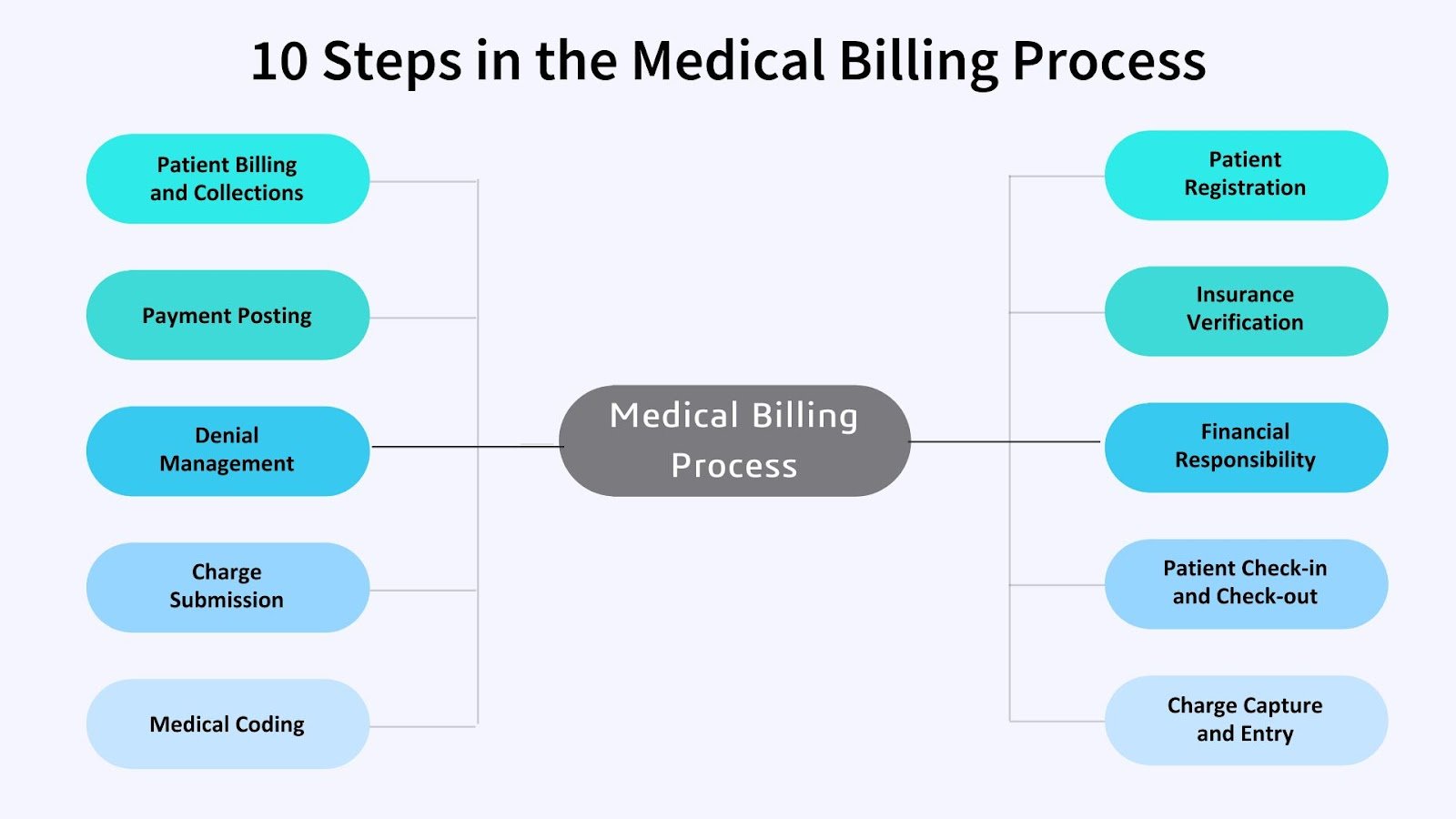

Below are the steps involved in RCM:

1. Appointment Scheduling: It is a starting step of RCM where the patient schedules an appointment with a provider through a call or website. The appointment scheduling phase allows patients to avoid unnecessary waiting time or the doctor’s unavailability can waste the patient’s valuable time.

2. Eligibility and Benefit Verification: It involves verification of patient eligibility and benefits with the payer by the provider. It can either be done on call or information provided by the patient can be validated on the payer website or the patient can provide an insurance ID card when visiting the provider. It is necessary to check eligibility to verify whether the patient is eligible for the services going to be performed. Even if the patient is a regular customer, it needs to be checked each time before rendering the new service since the patient may have changed the policy and associated with different insurance.

3. Registration and Pre-Encounter: In the Registration phase, the patient’s documentation work gets completed where the patient acknowledges financial responsibility and provide authority to the provider to collect revenue from insurance for the services rendered by signing important documents. The pre-Encounter phase involves getting authorization, Availability of required instruments or Reports while performing the service. All these formalities are completed 24 hours prior to the encounter phase.

4. Encounter: This is a phase where actual services are performed and while performing the service, the physician, nurse or other healthcare practitioners record the dictation of the entire treatment in a voice recording device such as Dictaphone or mobile phone which helps the medical transcriptionist to create medical records.

5. Medical Transcription: Medical Transcription or MT is a step where a Medical Transcriptionist transcribes the dictation of treatment done by a physician, nurse, or other healthcare practitioners in a recording device into the required format of Medical records.

6. Medical Coding: It is a phase where a team of professional medical coders use the medical records and provide CPT (Procedure code) and ICD-10 code (Diagnosis Code) for the procedure performed. There are set of medical CPT codes that describe medical, surgical, and diagnostic services. ICD 10 code contains code for diseases, signs, symptoms, abnormal findings, complaints, social circumstances, and external causes of injury and diseases. Medical coders have a thorough knowledge of these codes and correct coding will reduce the time to reimburse the payment of the services.

7. Demographic and charge Entry: In this phase, the Patient’s demographic and Medical codes are entered into the system or PMS (Practice management system). This data needs to be entered into the system correctly or it will lead to rejection from the clearing house or denial from the insurance company.

8. Claim Submission: Once all the demographic and charge entries are done in the system the claim needs to be sent to insurance using the claim form. There are 2 types of claim forms used to send claims to insurance for processing, CMS 1500 and UB 04. CMS 1500 form is used for physician billing and it has 33 blocks whereas UB 04 form is used for Hospital billing and it has 81 Locators. These claim forms include all the information such as patient information, Rendering or Referring provider information, Billing provider information, and charge details.

9. Clearing House and Payer Rejection: When a claim is submitted from the system and there is no format issue then it goes to the clearing house which acts similarly as a system scrubber but rejected the claim after checking additional information among Patients, Payers, and Providers. These rejections could be patient eligibility issues, provider enrollment issues, payer ID issues, etc. So, always check the clearing house to verify whether claims have been forwarded to the Insurance company or not. Once the claim is submitted to the insurance company and there is no rejection given by the clearing house then it goes to the payer rejection system which again validates the claims before sending it for processing. It validates the same information as the clearing house but sometimes it is not necessary that the clearing house has all the information about the patient, payer, or provider, and due to this missing information, claims are accepted by the clearing house and sent to the insurance company but Payer rejection rejects the claims if all these data are not correct.

10. Insurance: Insurance is also called a Payer and when there is no error from payer rejection then it is accepted by Insurance and sends claims for processing. Claims would either pay or deny if there will be any issues. Insurance generates EOB (Explanation of Benefit) for paper claims and ERA (Electronic Remittance Advise) for electronic claims. These EOB and ERA are generated for each paid or denied claim and sends it to the provider.

11. Payment Posting: The provider receives EOBs and ERAs from the Insurance company and it includes payment or denial information that needs to be posted in the system which is done by the Payment posting team. Sometimes EOBs are not received by the provider since it is sent via mail or maybe misplaced, so the payment posting team uses the website to obtain these EOBs.

12. AR (Account Receivable): There are some scenarios when the provider does not receive any EOB/ERA or information received on EOB or ERA is not understandable then it’s the AR team’s responsibility who called the insurance and verify all the required details to get the claim paid.

13. Denial Management: It involves the investigation of unpaid claims or partially paid claims with denial reasons. Based on different scenarios need to take appropriate action to resolve these denials and get the claim paid. Such as denials related to coding issue are sent to the coding team to review, appeal denials required appeals to be sent and Credential issue requires enrollment of providers to be completed with the payer.