What’s a Premium, Really?

Think of your premium as a subscription fee. It’s the amount you pay every month—whether or not you use any medical services.

Key facts about premiums:

- Paid monthly (sometimes quarterly or annually)

- Non-refundable—use it or not, it’s gone

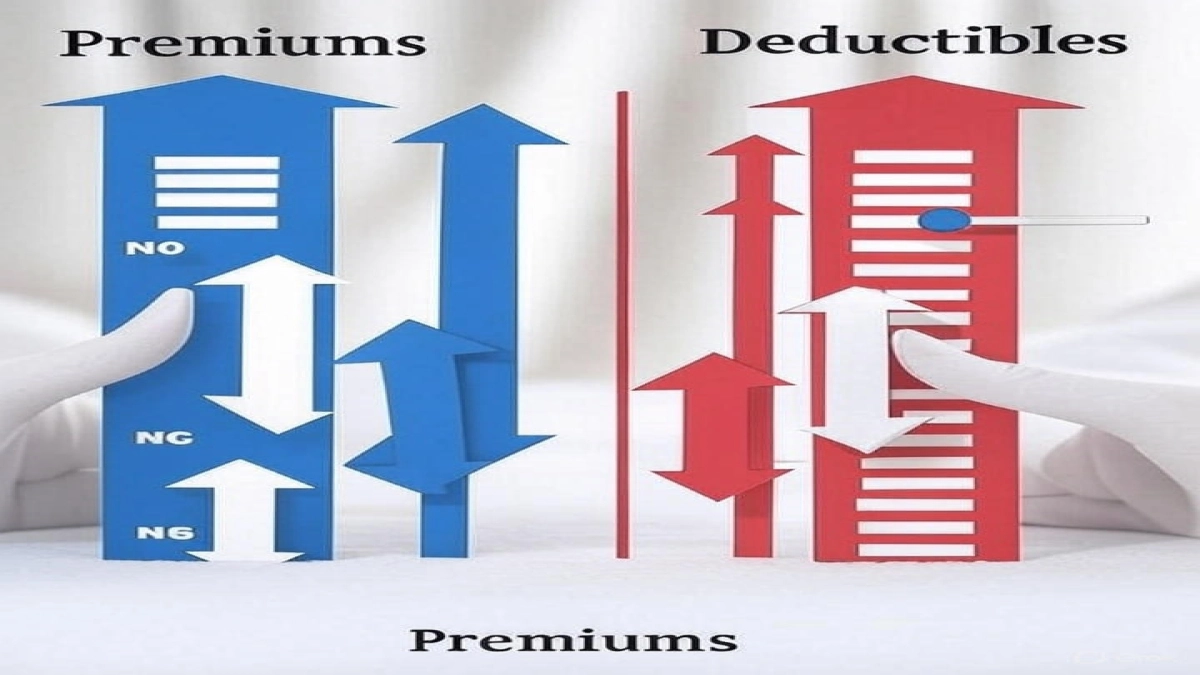

- Lower premiums often mean higher deductibles (more on that in a minute)

- Can vary by plan type, age, location, and risk level

🔍 “Why is my premium so high?”

If your plan offers broad coverage, low deductibles, or access to a large provider network, your premium will reflect that.

Now About That Deductible…

Your deductible is what you must pay out-of-pocket before your insurance kicks in.

So, if your deductible is $2,000, you’ll pay the first $2,000 of covered services yourself. After that, your insurance starts covering most of the cost (typically with copays or coinsurance still involved).

Key facts about deductibles:

- Annual reset (usually January 1st)

- High deductible = lower monthly premium (usually)

- Can apply to individuals or family totals

- May not apply to all services (e.g., preventive care might be fully covered even before deductible)

The Real Trade-Off: High Deductible vs Low Premium

Here’s where the math—and strategy—comes in. There’s no one-size-fits-all answer, but understanding the balance between premiums and deductibles can help you choose the right plan (or guide patients to one).

🧮 Let’s Break It Down:

| Plan Type | Monthly Premium | Deductible | Best For |

|---|---|---|---|

| High Deductible Health Plan (HDHP) | $100 | $5,000 | Young, healthy individuals who rarely visit doctors |

| Low Deductible Plan | $400 | $500 | People with chronic conditions or frequent care needs |

Medicare Deductible:

- A deductible is a fixed amount that a patient needs to pay before the insurance company starts paying.

- The deductible amount may vary by the plan and it starts over every year. A patient needs to reach this deductible amount each year before the insurance company starts paying.

- CMS releases Medicare deductible amounts every year and below is the list of medicare deductible amounts released by CMS in the last few years,

Medicare Premium:

- CMS releases Medicare premium amounts every year.

- Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

- For the year 2024, the standard monthly premium for Medicare Part B enrollees is $174.70 but it differs based on medicare beneficiaries’ high income.

- Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: