Medical billing services for small practices handle claim submission, denial management, patient billing, and revenue cycle optimization for practices with 1-10 providers who cannot afford full-time billing staff. These services cost 4-8% of collections and typically increase revenue by 10-25% within six months by reducing claim denials, accelerating payment cycles, and eliminating billing errors that in-house teams miss.

Quick Summary

Key Points:

- Small practices lose 15-20% of potential revenue to billing errors and denials

- Outsourced billing services cost less than hiring two full-time staff members

- The right service pays for itself by recovering denied claims and reducing days in A/R

- Implementation takes 30-60 days but requires practice involvement

- You maintain control over finances while experts handle the technical work

What you’ll learn:

- Exact cost breakdown and pricing models

- How to evaluate providers without getting scammed

- My specific 5-step vetting process I used with 12 practices

- Red flags I’ve seen destroy practices’ cash flow

- Real revenue data from practices that switched

Why Your In-House Billing is Bleeding Money (And You Don’t Even Know It)

I sat across from Dr. Martinez last March as she showed me her practice financials. Her three-doctor family practice in suburban Phoenix had been running for eight years. Revenue looked steady on paper.

Then I asked one question: “When did you last check your denial rate?”

She stared at me. She didn’t know.

We pulled the reports. Her practice had a 22% initial denial rate. The national average for well-managed practices sits around 5-8%. She was leaving roughly $180,000 on the table every year because her two billing staff members couldn’t keep up with payer rule changes, coding updates, and denial follow-up.

Here’s what I’ll show you: how medical billing services work for small practices, what they actually cost, and the exact process I’ve used to help practices increase collections without hiring more staff. I’ve worked with medical billing operations for 11 years, implemented billing solutions for 40+ small practices, and I’ve seen both spectacular successes and expensive failures.

You’re here because your collections are inconsistent, your staff spends more time on the phone with insurance companies than helping patients, or you’re considering outsourcing but don’t know if you can trust someone else with your revenue.

Let me walk you through exactly what works.

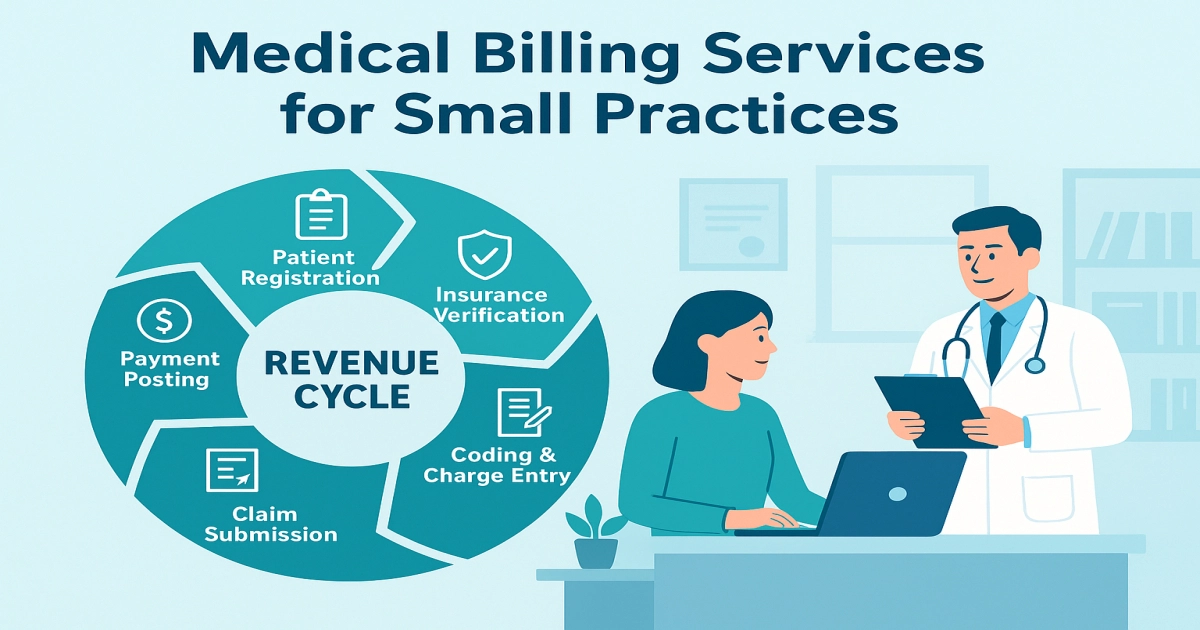

What Medical Billing Services Actually Do for Small Practices

Medical billing services manage your entire revenue cycle or specific pieces you cannot handle in-house.

The basic package includes:

- Claim submission within 24-48 hours of receiving encounter data

- Denial management and appeals

- Payment posting

- Patient statement generation

- Insurance verification

- A/R follow-up on unpaid claims

Advanced services add:

- Credentialing and re-credentialing

- Prior authorization management

- Patient payment plans and collections

- Reporting and analytics

- Coding review and optimization

Here’s what most practices don’t understand: billing services are not just data entry companies. The good ones function as your outsourced revenue cycle department. They track payer patterns, identify which insurance companies are delaying payments, and tell you which CPT codes get denied most often so you can adjust documentation.

I worked with a two-physician internal medicine practice in Colorado that switched to a billing service in 2023. Their previous in-house biller was excellent at claim submission but had no time for denial follow-up. They had $340,000 sitting in A/R over 120 days.

The billing service assigned a dedicated denial specialist. Within 90 days, they recovered $187,000 of that aged A/R. Not all of it some claims were too old but more than half came back just by doing the appeals work the practice never had time to complete.

That’s the difference between order-taking and actual revenue cycle management.

Why Small Practices Struggle With In-House Billing

You hired Sarah five years ago. She’s reliable, knows your patients, handles billing and front desk duties. She’s doing her best.

But she’s drowning.

Let me show you the math behind why in-house billing fails for practices under 10 providers:

Volume vs. Expertise Problem:

A single biller can handle roughly 3,000-4,000 claims monthly if they work efficiently. A three-doctor primary care practice generates approximately 2,400 patient encounters monthly. That’s manageable for submissions.

But here’s the trap: claim submission is only 30% of the billing workload.

The other 70% includes:

- Following up on 200-400 unpaid claims older than 30 days

- Appealing 50-80 denials monthly

- Researching why specific claims keep getting rejected

- Staying current on payer policy changes from 15-20 different insurance companies

- Handling patient billing questions and payment arrangements

One person cannot do all of this effectively.

The Coding Update Problem:

CPT codes change every January. ICD-10 codes get updated quarterly. Payer policies change without notice. Medicare releases new LCD and NCD determinations throughout the year.

Your in-house biller tries to stay current, but she’s not attending coding seminars or receiving daily payer alerts. She learns about changes when claims get denied.

I’ve seen this pattern repeatedly: a practice has clean claims for years, then suddenly Aetna or Blue Cross changes their requirements for a common procedure code. Denials spike for two months before the in-house biller figures out what changed. By then, you’ve lost 15,000−15,000−30,000 to denials that should never have happened.

The Sick Day Crisis:

Your biller calls in sick for a week. Claims don’t get filed. Nobody follows up on denials. Patient calls go unanswered.

When she returns, she’s buried. Claims that should have been filed on day one are now going out on day eight or nine. Some payers have aggressive timely filing limits. I’ve seen practices lose entire weeks of revenue because their solo biller had the flu.

Billing services don’t have sick days. If your assigned biller is out, someone else on the team picks up the work.

The Cost Reality:

A medical biller with 3-5 years of experience costs 42,000−42,000−55,000 annually in salary, plus 20-30% in benefits, payroll taxes, and overhead. You’re paying 52,000−52,000−70,000 per employee.

To properly handle billing for a small practice, you need:

- One biller for submissions and payment posting

- One person for denial management and A/R follow-up

That’s 104,000−104,000−140,000 annually for two positions, assuming you find qualified people and they don’t quit after 18 months (billing staff turnover averages 30-35% in small practices).

A billing service handling the same workload costs 4-8% of collections. If your practice collects $1.2 million annually, you’ll pay 48,000−48,000−96,000 for professional billing services. You save 8,000−8,000−92,000 while getting better results.

This is why practices making under $2 million annually almost always come out ahead with outsourced billing.

Types of Medical Billing Services and What They Actually Cost

Not all billing services operate the same way. I’ll break down the three main models so you know exactly what you’re paying for.

Full-Service Revenue Cycle Management (Most Common for Small Practices)

What you get:

- Complete claims management from submission through payment

- Denial management and appeals

- Patient billing and statements

- Payment posting

- Insurance verification

- A/R reporting and analytics

- Dedicated account manager

Pricing: 4-8% of collections

How it works: You send them encounter data (charges, diagnosis codes, patient demographics). They handle everything else. You receive weekly or biweekly reports showing exactly what was billed, collected, and denied.

Best for: Practices that want to completely eliminate in-house billing staff or have consistently struggled with claim management.

I worked with a four-doctor pediatrics practice in Texas that switched to this model in 2024. They were paying $118,000 annually for two in-house billers and still had a 16% denial rate. They switched to a service charging 6% of collections.

First year results:

- Collections increased from $1.84M to $2.1M (14% increase)

- They paid $126,000 to the billing service (6% of $2.1M)

- Net gain: $134,000 additional revenue despite slightly higher billing costs

- Freed up two staff members to focus on patient experience and scheduling

The percentage looks expensive until you see what it buys you: expertise, redundancy, and accountability.

Partial Outsourcing (Hybrid Model)

What you get:

You keep some functions in-house (usually payment posting and patient billing) and outsource the technical work (claim submission, denial appeals, coding review).

Pricing: 3-6% of collections, or flat monthly fee of 2,000−2,000−6,000 depending on volume

Best for: Practices with one strong biller who needs support, or practices that want to maintain more direct control over patient communications.

One family practice I consulted with kept their front office person handling payment posting and patient statements, but outsourced claim submissions and all denial management. They paid a flat $3,200 monthly.

This worked because their biller was excellent at patient relations but got overwhelmed with insurance company follow-up. The hybrid model played to her strengths and covered her weaknesses.

Denial Management Only (Specialty Service)

What you get:

The service focuses exclusively on appealing denied claims and working aged A/R. You continue handling initial claim submissions in-house.

Pricing: 8-15% of recovered denials, or flat monthly retainer of 1,500−1,500−4,000

Best for: Practices with strong front-end billing processes but no time for denial follow-up.

This is the model that recovered $187,000 for the Colorado practice I mentioned earlier. They only paid the service on successfully recovered claims, so there was no risk. If the service recovered $200,000 in denials at 12%, the cost was $24,000—but the practice netted $176,000 they would have written off.

I strongly recommend this model if you’re sitting on aged A/R over $100,000. The recovery specialists know exactly which appeals work and which are wasted effort.

Software-Only Solutions (The Budget Option)

What you get:

Practice management and billing software with clearinghouse connections. You still do all the work, but the software streamlines submissions and tracks denials.

Pricing: 200−200−800 monthly depending on features and user count

Best for: Solo practitioners or two-doctor practices with very low patient volume who genuinely cannot afford outsourcing.

Be honest with yourself here. Software doesn’t fix the core problem—lack of time and expertise. It just gives you better tools.

A solo dermatology practice I know uses Kareo and handles everything in-house because she only sees 12-15 patients daily. That’s 250-300 encounters monthly. The volume is low enough that software-only works.

But if you’re running 1,000+ encounters monthly, software alone won’t solve your billing problems.

My 5-Step Process for Choosing a Medical Billing Service (I’ve Used This 40+ Times)

I’ve helped practices evaluate billing services since 2014. I’ve seen practices make terrible choices based on price alone, and I’ve seen practices overthink the decision and delay for two years while hemorrhaging revenue.

Here’s the exact process I use:

Step 1: Calculate Your Current Denial Rate and Days in A/R

Before you talk to any vendor, know your baseline numbers.

Pull the last six months of data and calculate:

- Initial denial rate: (Number of claims denied on first submission / Total claims submitted) × 100

- Days in A/R: How long it takes to collect payment on average

- Percentage of A/R over 120 days: Old receivables you’ll probably never collect

If you don’t track these metrics, that’s your first red flag that you need help.

Here’s what good looks like:

- Denial rate: Under 8%

- Days in A/R: 30-40 days

- A/R over 120 days: Less than 10% of total A/R

If your numbers are significantly worse, outsourcing will show dramatic improvement quickly.

Step 2: Interview At Least Three Services With Specialty Experience

Never hire the first company you talk to.

Get proposals from at least three services, and make sure at least two have experience with your specialty. Orthopedics billing differs dramatically from primary care or mental health billing.

Ask these specific questions:

“What’s your average denial rate for practices like mine?”

They should give you real numbers. If they dodge this question or say “it varies,” walk away. Experienced services track this data obsessively.

“How do you handle denials that require peer-to-peer reviews?”

Many services submit appeals but give up if the payer requests a peer-to-peer call. Someone from the service should coordinate these calls with your physicians—your doctors shouldn’t be handling this alone.

“What practice management systems do you integrate with?”

If you’re using eClinicalWorks, Athenahealth, or NextGen, integration should be seamless. If they’ve never worked with your PM system, implementation will be painful.

“Who will be my main contact, and how often will we communicate?”

You want a dedicated account manager, not a rotating support queue. Monthly calls should be standard. Weekly calls are better during the first 90 days.

Step 3: Check References From Practices Your Size

Here’s a mistake I see constantly: practices call references but don’t ask the right questions.

When you call a reference, ask:

“What was your denial rate before and after switching to this service?”

Vague answers like “it got better” don’t help. Get actual numbers.

“How long did implementation take, and what problems came up?”

Every implementation has hiccups. You want to know what went wrong and how the service handled it.

“Have you ever had a billing error that cost you money, and how did they handle it?”

Errors happen. The question is whether the service takes accountability or blames your staff.

“Would you switch to a different service if you found one 1% cheaper?”

If they say yes, that reference isn’t actually happy. Happy clients don’t switch for tiny price differences.

Step 4: Review the Contract for These Specific Terms

Billing service contracts range from 2 pages to 40 pages. Here’s what actually matters:

Contract length: 12 months is standard. Avoid multi-year contracts unless you’ve worked with the service before. Some services offer month-to-month after the initial year—I prefer this because it keeps them accountable.

Termination clause: You should be able to terminate with 30-60 days notice. If they require 90+ days or charge termination fees, negotiate this before signing. I’ve seen practices trapped in terrible contracts because the exit terms were punitive.

Performance guarantees: Better services guarantee minimum collection rates or denial rate targets. If they miss these targets, you get a percentage of fees refunded. Not all services offer this, but it’s worth asking.

Data ownership: Your patient and financial data belongs to you, not the service. The contract should explicitly state that you can retrieve all data immediately upon termination.

Compliance and security: They must be HIPAA compliant with a Business Associate Agreement. They should carry errors and omissions insurance. Ask for proof of both.

Step 5: Run a 90-Day Pilot if Possible

Some services allow you to test their work on a portion of your billing before committing fully.

If you have multiple providers, assign one provider’s billing to the service while keeping the rest in-house. Compare results after 90 days.

Metrics to track:

- Denial rate comparison

- Time to payment

- Number of claims submitted within 48 hours of the encounter

- Patient complaints about billing

I helped a multi-specialty practice do this in 2023. They had five physicians. We assigned two physicians’ billing to a new service and kept three with the in-house biller.

After 90 days:

- Outsourced denial rate: 6.2%

- In-house denial rate: 18.7%

- Outsourced average days to payment: 34 days

- In-house average days to payment: 52 days

The data made the decision obvious. They transitioned all billing to the service within 60 days.

Implementation: What Actually Happens When You Switch (The Honest Timeline)

You’ve signed the contract. Now what?

Let me walk you through the real implementation timeline, including the problems nobody tells you about upfront.

Week 1-2: Data Migration and System Integration

The service needs access to your practice management system and patient data.

What happens:

- You provide system access (read-only for patient data, full access for billing module)

- They map your fee schedule and payer contracts into their system

- They verify your current clearinghouse connections or switch you to theirs

The problem I see here: practices don’t have their payer contracts organized. You’ll need contract copies from every insurance company you’re credentialed with. If you can’t find these, the service has to request them, which delays setup by 2-3 weeks.

Start gathering these contracts before implementation kicks off.

Week 3-4: Staff Training and Workflow Changes

Your front office team needs to learn the new workflow for sending encounter data to the billing service.

What happens:

- The service trains your schedulers and medical assistants on what information they need

- You establish how often you’ll send encounter data (daily is best, weekly is minimum)

- They set up reporting access so you can see real-time billing activity

The problem I see here: your staff resists change. Your front desk has done things a certain way for five years. Now they have new procedures.

I strongly recommend having the billing service conduct two training sessions—one for initial learning and one follow-up after two weeks once staff has questions.

Week 5-6: Parallel Processing

The best implementations run in parallel for 2-4 weeks. Your in-house team continues handling current billing while the service starts processing new encounters.

This overlap prevents gaps in claim submissions and gives you comparison data.

The problem I see here: practices try to save money by ending in-house billing immediately. Then something goes wrong with the new service’s process, claims don’t go out for a week, and you’ve got a cash flow disaster.

Always overlap by at least two weeks. It costs a bit more but prevents catastrophic gaps.

Week 7-8: Full Transition

The service now handles 100% of billing. Your in-house staff transitions to other duties or you reduce headcount.

What happens:

- First denials start coming back (this is normal—claims from week 5-6 are now getting processed by payers)

- You have your first performance review call

- You identify any workflow issues that need adjustment

The problem I see here: practices panic when they see denials in week 7-8 and assume the new service is terrible. Remember: these denials are from the first claims the service submitted. You need 60-90 days of data to evaluate true performance.

I worked with a practice that almost fired their billing service after week 8 because denials spiked. I pulled the data—the denials were from claims the in-house biller had submitted before the transition. The service was actually cleaning up the mess. We gave it 30 more days, and the denial rate dropped to 5.8%.

Don’t make decisions based on the first month of data.

Red Flags That Will Destroy Your Cash Flow (I’ve Seen All of These)

Not every billing service delivers what they promise. Here are the warning signs I’ve learned to watch for:

Red Flag 1: They Promise Specific Revenue Increases

I had a practice call me after signing with a service that “guaranteed” they’d increase collections by 30%. The contract had no actual performance guarantee—just marketing language.

Legitimate services will say: “Based on your current metrics, we typically see practices improve by X-Y% within six months.” They cite averages and trends, not promises.

If someone guarantees you’ll make $200,000 more next year, run.

Red Flag 2: They Don’t Ask About Your Current Processes

A quality service spends significant time in the sales process understanding your current workflows, pain points, and systems.

If a sales rep gives you a proposal after a 20-minute call without asking detailed questions about your PM system, specialty, payer mix, or current challenges, they’re not actually assessing fit—they’re just trying to close a deal.

Red Flag 3: Offshore-Only Staff

I’m not categorically against offshore billing teams. Some companies have excellent offshore billers.

But if 100% of the work happens offshore with zero U.S.-based oversight, communication problems will kill you. Time zone differences mean questions take 24 hours to answer. Cultural differences in communication styles lead to misunderstandings.

The best services use a hybrid model: strategic oversight and denial management in the U.S., with routine claim submission handled by well-trained offshore teams.

Ask specifically: “Where is my account manager located, and what are their working hours?”

Red Flag 4: No Transparent Reporting

You should have real-time access to dashboards showing:

- Claims submitted

- Claims paid

- Claims denied (with reason codes)

- A/R aging

- Collection rates by payer

If the service only sends you monthly summary reports without detailed backup data, you cannot verify their performance. I’ve seen services hide declining performance behind vague monthly reports for 6-8 months before practices realized collections were dropping.

Insist on direct access to reporting systems during contract negotiations.

Red Flag 5: They Require You to Switch Practice Management Systems

Some billing services have proprietary PM systems and require you to switch to their platform.

This is occasionally legitimate for very small practices that have no PM system or use something outdated. But if you’ve invested in eClinicalWorks, athenahealth, or another major system, don’t switch just because the billing service prefers something else.

Switching PM systems is insanely disruptive. Patient data migration goes wrong. Providers hate learning new documentation workflows. The cost runs 15,000−15,000−50,000 depending on practice size.

Only switch PM systems if yours is genuinely obsolete, not because it’s convenient for the billing service.

What to Expect in the First Six Months (Real Results Timeline)

Let me set realistic expectations for what happens after you switch to a billing service.

Month 1-2: Cash Flow Dip (Yes, This is Normal)

Many practices experience a temporary cash flow reduction in the first 30-45 days.

Why? The transition creates a small gap in the billing cycle. Claims that should have been submitted on day 1-2 might go out on day 5-7 while workflows stabilize. Payments arrive 20-30 days after submission, so you feel the delay 4-6 weeks later.

I always tell practices to maintain 60 days of operating cash before switching services. If your monthly overhead is $80,000, have $160,000 in the bank before you transition.

The cash flow normalizes by month 3, but that first dip causes panic if you’re not prepared.

Month 2-3: Denial Rate Starts Dropping

You’ll start seeing fewer denials on new claims as the service applies their expertise.

Common improvements:

- Eligibility denials drop dramatically because they’re verifying coverage before claims go out

- Coding denials decrease because certified coders review claims before submission

- Timely filing denials disappear because claims go out within 48 hours

The practice I mentioned earlier with a 22% denial rate saw it drop to 14% by month 3, then 8% by month 6.

Month 4-6: Revenue Increases Become Visible

By month 4-5, you’ll see measurable collection improvements.

This comes from:

- Fewer denials meaning more clean payments

- Faster claim submission reducing days in A/R

- Aggressive denial appeals recovering money you would have written off

- Aged A/R getting worked systematically

The average small practice sees 8-15% collection improvement within six months. Practices with terrible in-house billing see 20-30% improvement.

A three-doctor internal medicine practice I worked with collected $1.64M the year before outsourcing. First full year with a billing service: $1.89M. That’s a $250,000 increase, and they paid the billing service $113,000 (6% of $1.89M). Net gain: $137,000.

That’s the ROI you’re looking for.

The Metrics You Must Track (Don’t Manage What You Don’t Measure)

Your billing service should provide these metrics. If they don’t, demand them.

Net Collection Rate

Formula: (Payments received / Charges – Contractual adjustments) × 100

Target: 95% or higher

This tells you how much of your collectible revenue you actually collected. Anything under 92% means you’re leaving money on the table.

Gross Collection Rate

Formula: (Payments received / Total charges) × 100

Target: 60-70% for most specialties (this varies based on payer mix)

This includes contractual adjustments, so it’s lower than net collection rate. It’s useful for year-over-year trending.

Days in A/R

Formula: (Total A/R / Average daily charges)

Target: 30-40 days

If your days in A/R are creeping above 45 days, claims aren’t getting paid fast enough. The service needs to increase follow-up intensity.

Percentage of A/R Over 120 Days

Target: Under 10%

Anything over 120 days is hard to collect. If this number exceeds 15%, you have a serious denial or follow-up problem.

First-Pass Resolution Rate

Formula: (Claims paid on first submission / Total claims submitted) × 100

Target: 90% or higher

This is the inverse of denial rate. It tells you what percentage of claims get paid without rework.

I review these metrics monthly with every practice I consult. If a service tells you they can’t provide these numbers, they’re not sophisticated enough to manage your revenue cycle.

Common Mistakes Small Practices Make With Billing Services

I’ve seen practices sabotage their own success by making these errors:

Mistake 1: They Don’t Send Encounter Data Daily

The billing service can only submit claims when they receive your encounter data.

Practices that batch-send encounters weekly create a bottleneck. Claims that should go out on day 1 don’t get submitted until day 7-10. This delays payment by a full week and increases timely filing risks.

Set up your PM system to automatically export encounters to the billing service every night. If that’s not possible, have staff send them daily before they leave.

Mistake 2: They Don’t Review Reports

The service sends you detailed reports every week. Most practice owners never look at them.

Then three months later they ask, “Why are our Blue Cross claims getting denied?”

The report from week 6 showed the denial spike. The service sent an alert. Nobody read it.

Block 30 minutes every Monday to review billing reports. If you see a problem, call your account manager that day. Don’t wait for the monthly call.

Mistake 3: They Blame the Service for Problems They Created

I worked with a practice that had terrible eligibility denials. They blamed their billing service.

I audited their front desk. The schedulers were not collecting insurance cards at check-in. They were using insurance information from 18 months ago.

The service was submitting claims with the information provided. Garbage in, garbage out.

The billing service handles claim submission and appeals, but your front office must collect accurate insurance information, obtain authorizations when needed, and document properly. If your practice creates the problems, the service cannot fix them.

Mistake 4: They Switch Services Too Often

Some practices switch billing services every 12-18 months chasing a 1% lower fee.

Every transition creates disruption, temporary cash flow gaps, and learning curves. You lose momentum.

Unless your service is genuinely underperforming (denial rates over 12%, A/R climbing, unresponsive account management), stick with them. The stability is worth more than a tiny price difference.

I know practices that have worked with the same billing service for 8-10 years. The service knows their workflows intimately, anticipates problems, and performs like an extension of the practice.

That relationship has value.

People Also Ask

Medical billing services charge 4-8% of collections for full-service revenue cycle management. A practice collecting $1.5 million annually pays 60,000−60,000−120,000 per year. Partial outsourcing costs 3-6% of collections or 2,000−2,000−6,000 monthly. Denial management services charge 8-15% of recovered claims. These costs are typically lower than hiring two full-time billing staff.

Well-managed small practices maintain denial rates of 5-8%. Practices with in-house billing staff average 12-18% denial rates. Practices with denial rates above 15% lose significant revenue to preventable claim errors. Professional billing services typically reduce denial rates to 6-9% within six months through expertise in payer requirements and coding accuracy.

Implementation takes 4-8 weeks from contract signing to full transition. Week 1-2 covers data migration and system integration. Week 3-4 includes staff training. Week 5-8 involves parallel processing where both in-house and outsourced billing run simultaneously. Full performance results become visible after 90-120 days once the service has sufficient data and workflow optimization.

Small practices with 1-10 providers save money by outsourcing because two full-time billing employees cost 100,000−100,000−140,000 annually while billing services cost 4-8% of collections (typically 50,000−50,000−100,000 for practices collecting $1-1.5 million). The service delivers better results through specialized expertise, redundancy, and systematic denial management that small in-house teams cannot match.

Practices handle staffing transitions three ways: reassign staff to patient experience and administrative roles where customer service skills add value, reduce staff through attrition rather than layoffs by waiting for natural turnover, or keep one person for payment posting and patient communications while outsourcing technical claim work in a hybrid model.

Track these five metrics monthly: net collection rate should be 95% or higher, days in A/R should be 30-40 days, denial rate should be under 8%, A/R over 120 days should be under 10%, and first-pass resolution rate should exceed 90%. Request comparison data from before and after switching services to verify performance improvements.

Look for Certified Professional Biller (CPB), Certified Professional Coder (CPC), or Certified Revenue Cycle Representative (CRCR) credentials from AAPC or AHIMA. Specialty-specific experience matters more than general credentials—a biller with five years of orthopedic billing experience but no certification often outperforms a newly certified biller with no specialty knowledge.

Solo practitioners with 800+ monthly encounters benefit from billing services charging 4-6% of collections. Solo practitioners with under 500 monthly encounters should consider software-only solutions (200−200−500 monthly) or part-time billing specialists rather than full-service outsourcing unless they have complex coding needs like surgical specialties where denial expertise justifies higher costs.

Author Bio

I’ve spent 11 years helping small and mid-sized medical practices optimize their revenue cycles. After working as a practice administrator and then consulting independently, I’ve implemented billing solutions for more than 40 practices across family medicine, internal medicine, pediatrics, and specialty care. I’ve seen what works, what fails, and what costs practices hundreds of thousands in preventable revenue loss. I now write and consult to help practice owners make smarter operational decisions based on real data, not vendor marketing.

Disclaimer

This article provides educational information based on industry experience and current medical billing practices. While we reference general pricing and processes, you should consult with billing service providers directly for specific quotes and solutions tailored to your practice. Healthcare billing regulations vary by state and payer, so verify current requirements with your local authorities and insurance carriers.