Copay is a fixed amount you pay for a healthcare service—like $25 for a doctor visit—while coinsurance is a percentage of the total cost of care you pay after meeting your deductible—like 20% of a $1,000 procedure. Both are forms of cost-sharing but work very differently.

Understanding Copay: Fixed, Predictable Payments

Copay (or copayment) is a set fee you pay for medical services or prescriptions. It doesn’t change, no matter how expensive the service is. For example:

- $20 for a primary care visit

- $50 for a specialist

- $10 for generic medications

📌 Key Copay Highlights:

- Fixed dollar amount

- Paid at the time of service

- Used mostly for routine care

- Easy to budget for

Understanding Coinsurance: A Percentage-Based Cost

Coinsurance is a cost-sharing percentage you pay after meeting your deductible. If your coinsurance rate is 20%, and a procedure costs $2,000, you’ll pay $400 while your insurer pays the remaining 80%.

📌 Key Coinsurance Highlights:

- Based on a percentage of the bill

- Applies after the deductible

- Tends to affect costlier procedures

- Can lead to higher out-of-pocket costs

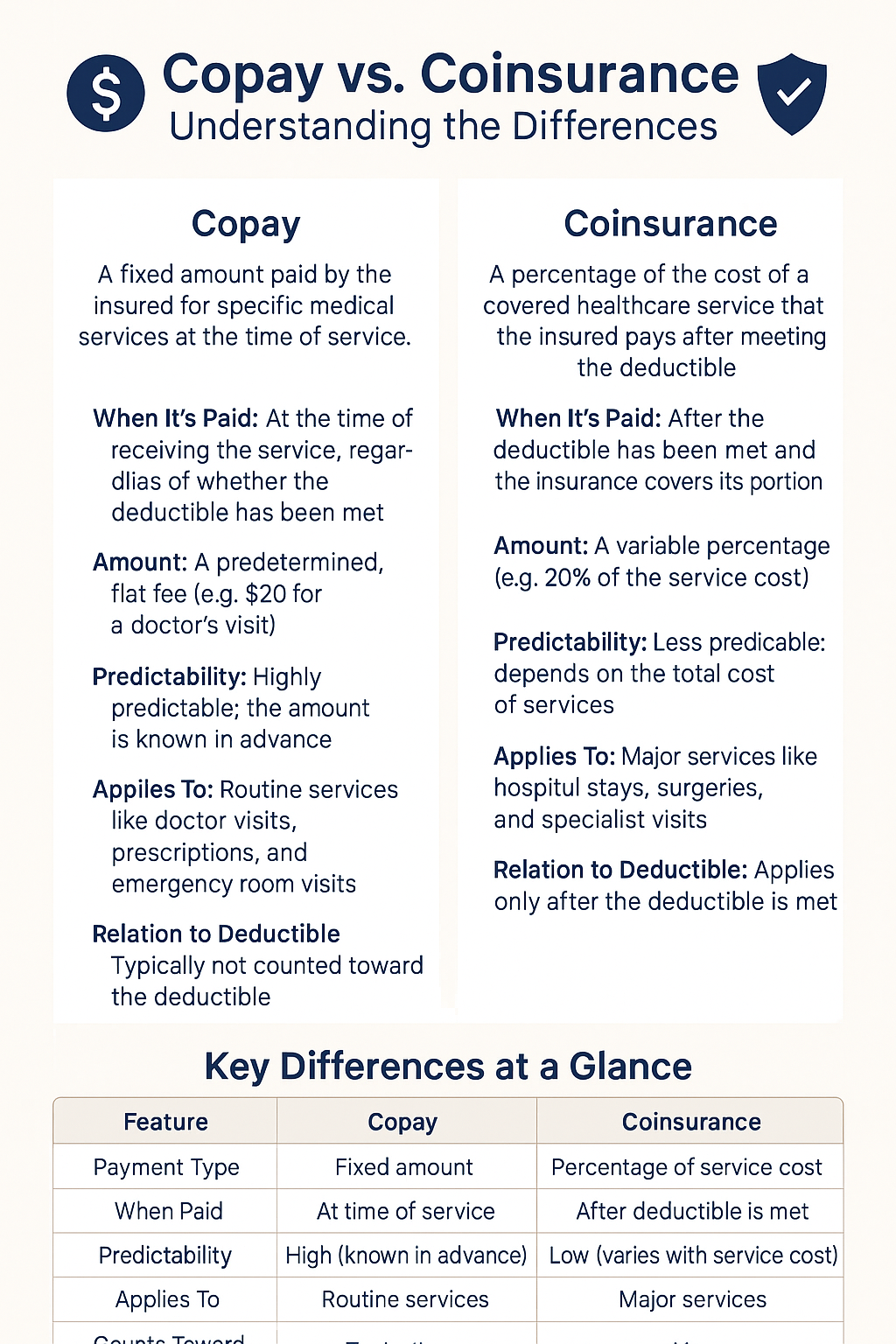

Side-by-Side Comparison Chart

| Feature | Copay | Coinsurance |

|---|---|---|

| What it is | Fixed dollar amount | Percentage of the cost |

| When it applies | Usually before deductible | After deductible is met |

| Amount type | Predictable and consistent | Varies with service cost |

| Example | $25 for doctor visit | 20% of a $1,000 surgery = $200 |

| Best for | Routine or minor care | Major or expensive procedures |

| Budget predictability | High | Low |

Real-Life Example: Making It Clear

Imagine you visit your primary care doctor:

- With copay, you pay a flat $30, regardless of total service cost.

- With coinsurance, if the visit costs $200 and you’ve met your deductible, you may owe 20%—or $40.

Why It Matters for Providers

Healthcare providers need to explain these cost types clearly to avoid confusion and improve patient satisfaction.

✅ Tips for Providers:

- Use plain language during check-in

- Display cost estimate charts

- Train staff on insurance literacy

- Clarify if a service is subject to coinsurance or copay

FAQs by Providers

A: Explain whether the charge is due to coinsurance and if their deductible has been met.

A: Yes, especially in tiered insurance plans—copay for the visit, coinsurance for additional services.

A: Not always. Some plans may use only copays, others coinsurance, and many use both depending on the service type.