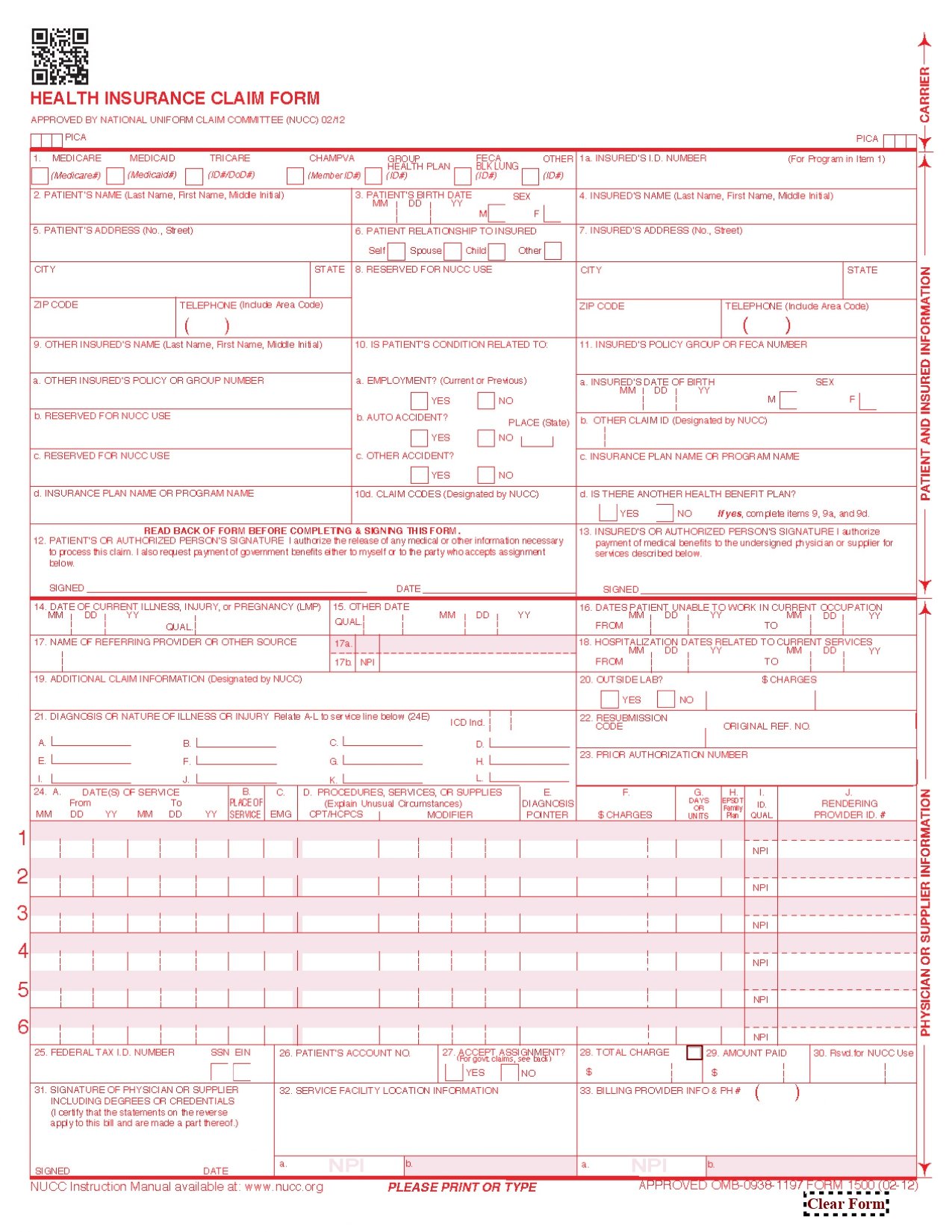

The HCFA CMS-1500 form is a standardized claim form used by healthcare providers in the United States to bill Medicare and Medicaid programs, as well as many private insurance companies. The form, developed by the Centers for Medicare & Medicaid Services (CMS), is essential for ensuring that healthcare providers receive reimbursement for services rendered to patients. This article provides a detailed overview of the CMS-1500 form, including a brief description of each box and its purpose.

HCFA CMS-1500.pdfOverview of the CMS-1500 Form

The CMS-1500 form is divided into 33 boxes (fields), each designed to capture specific information about the patient, provider, and services provided. The form is used primarily by non-institutional providers, such as physicians, nurse practitioners, chiropractors, and other healthcare professionals, to submit claims for payment.

Detailed Description of Each Box

Section 1: Provider Information

- Box 1: Type of Insurance

- Indicates the type of insurance coverage (e.g., Medicare, Medicaid, CHAMPUS, etc.).

- Box 1a: Insured’s ID Number

- The patient’s insurance identification number.

- Box 2: Patient’s Name

- The full name of the patient receiving the service.

- Box 3: Patient’s Date of Birth and Sex

- The patient’s birth date and gender (M/F).

- Box 4: Insured’s Name

- The name of the person holding the insurance policy (if different from the patient).

- Box 5: Patient’s Address

- The patient’s full address, including ZIP code.

- Box 6: Patient’s Relationship to Insured

- The patient’s relationship to the policyholder (e.g., self, spouse, child).

- Box 7: Insured’s Address

- The address of the insured person (if different from the patient).

- Box 8: Patient Status

- The patient’s marital status, employment status, and student status.

- Box 9: Other Insured’s Name

- If the patient has secondary insurance, this box includes the name of the other insured.

- Box 9a: Other Insured’s Policy or Group Number

- The policy or group number of the secondary insurance.

- Box 9b: Other Insured’s Date of Birth and Sex

- The birth date and gender of the secondary insured.

- Box 9c: Other Insured’s Employer or School Name

- The employer or school name of the secondary insured.

- Box 9d: Other Insurance Plan Name

- The name of the secondary insurance plan.

- Box 10a-c: Patient’s Condition Related To

- Indicates whether the patient’s condition is related to employment, an auto accident, or another type of accident.

- Box 11: Insured’s Policy, Group, or FECA Number

- The primary insurance policy or group number.

- Box 11a: Insured’s Date of Birth and Sex

- The birth date and gender of the primary insured.

- Box 11b: Employer’s Name or School Name

- The employer or school name of the primary insured.

- Box 11c: Insurance Plan Name

- The name of the primary insurance plan.

- Box 11d: Is There Another Health Benefit Plan?

- Indicates whether the patient has additional health coverage.

Section 2: Provider Information

- Box 12: Patient’s or Authorized Person’s Signature

- The patient’s signature authorizing the release of medical information.

- Box 13: Insured’s or Authorized Person’s Signature

- The insured’s signature (if different from the patient).

- Box 14: Date of Current Illness, Injury, or Pregnancy

- The date of onset of the patient’s condition.

- Box 15: Other Date

- Additional dates related to the patient’s condition (e.g., last menstrual period for pregnancy).

- Box 16: Dates Patient Unable to Work

- The dates the patient was unable to work due to illness or injury.

- Box 17: Name of Referring Provider

- The name of the provider who referred the patient (if applicable).

- Box 17a: NPI of Referring Provider

- The National Provider Identifier (NPI) of the referring provider.

- Box 18: Hospitalization Dates

- Dates of hospitalization related to the current services.

- Box 19: Additional Claim Information

- Any additional information required by the insurer.

- Box 20: Outside Lab?

- Indicates whether outside lab services were used and the charges.

- Box 21: Diagnosis or Nature of Illness

- The diagnosis codes (ICD-10) describing the patient’s condition.

Section 3: Service Information

- Box 22: Medicaid Resubmission Code

- Used for resubmitting claims to Medicaid.

- Box 23: Prior Authorization Number

- The prior authorization number (if required by the insurer).

- Box 24A-J: Service Lines

- Detailed information about each service provided, including:

- 24A: Date of service.

- 24B: Place of service.

- 24C: Type of service.

- 24D: Procedure code (CPT/HCPCS).

- 24E: Diagnosis pointer.

- 24F: Charges for each service.

- 24G: Days or units.

- 24H: EPSDT/Family planning indicator.

- 24I: ID qualifier.

- 24J: Rendering provider NPI.

- Detailed information about each service provided, including:

- Box 25: Federal Tax ID Number

- The provider’s federal tax identification number.

- Box 26: Patient’s Account Number

- The patient’s account number assigned by the provider.

- Box 27: Accept Assignment?

- Indicates whether the provider accepts assignment of benefits.

- Box 28: Total Charge

- The total amount charged for all services.

- Box 29: Amount Paid

- The amount already paid by the patient or insurer.

- Box 30: Balance Due

- The remaining balance due after payments.

- Box 31: Provider’s Signature

- The signature of the provider or authorized representative.

- Box 32: Service Facility Location

- The address of the facility where services were rendered.

- Box 33: Billing Provider Info and NPI

- The name, address, and NPI of the billing provider.

Conclusion

The HCFA CMS-1500 form is a critical tool for healthcare providers to ensure accurate and timely reimbursement for services rendered. Each box on the form serves a specific purpose, capturing essential information about the patient, provider, and services provided. Proper completion of the form is crucial to avoid claim denials or delays in payment. By understanding the purpose of each box, healthcare providers can streamline the billing process and maintain compliance with insurance requirements.