As we approach the end of the year, it’s really important for Medicare beneficiaries to take a moment to review their coverage, make any necessary adjustments, and prepare for the year ahead. Whether you’re enrolled in Original Medicare, a Medicare Advantage plan, or a standalone Part D prescription drug plan, knowing what steps to take at this time can help you dodge unexpected costs and ensure your health coverage meets your needs.

Every fall, Medicare plans send out an Annual Notice of Change, which highlights updates for the upcoming year. This document lays out changes to monthly premiums, deductibles, copays, provider networks, drug formularies, and any benefits that might have been added or removed. Even small changes can impact your out-of-pocket expenses.

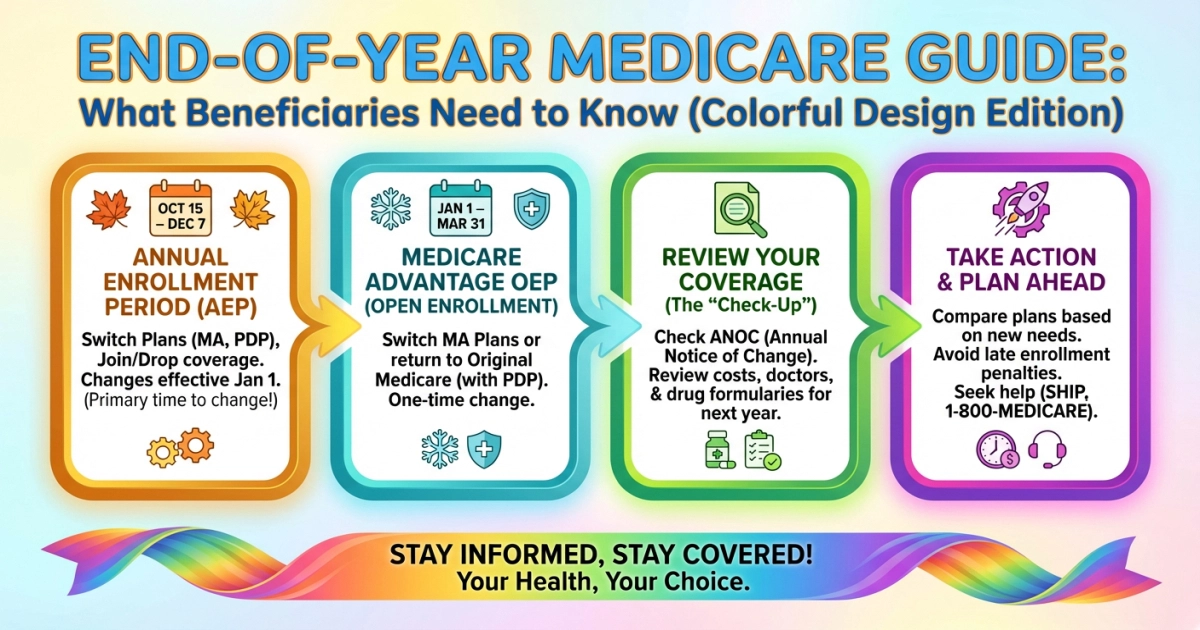

The end of the year is your final chance to tweak your Medicare coverage for the next year. During Open Enrollment, individuals had the opportunity to review their current plans and make necessary changes. Some options available include:

- Switching from Original Medicare to Medicare Advantage (or vice versa)

- Changing Medicare Advantage plans

- Joining, switching, or dropping a Part D prescription drug plan

Any changes you make during this period will kick in on January 1.

For those who didn’t make any changes during the annual open enrollment, there might still be a chance to do so. Individuals enrolled in the Elderly Pharmaceutical Insurance Coverage (EPIC) Program or New York State’s Pharmaceutical Assistance Program (SPAP) can still make changes before the year wraps up. You can join or change a Medicare Part D or Medicare Advantage plan once a year during a Special Enrollment Period (SEP), so you won’t have to wait for the regular open enrollment.

The Medicare Advantage Open Enrollment Period (MA OEP) takes place every year from January 1st to March 31st. If you’re already signed up for a Medicare Advantage plan, this is your opportunity to make a one-time change. You can either switch to a different Medicare Advantage plan or go back to Original Medicare, with or without a stand-alone Part D plan. If you experience certain qualifying life events, like moving or losing other coverage, you might be eligible for a broader Special Enrollment Period (SEP) that allows for mid-year plan changes.

Don’t forget to use any remaining benefits before December 31st! It’s wise to take advantage of unused perks like the Annual wellness visit, preventive screenings (such as mammograms, colorectal cancer screenings, and flu shots), and any dental, vision, or hearing benefits that come with your Medicare Advantage plan. Also, check if you have over-the-counter (OTC) allowances that you can use. Many of these benefits reset each year, so taking advantage of them now can help you save some cash. If you’re close to reaching your out-of-pocket limit for Medicare Advantage or your deductible for Part D, the end of the year is a great time to schedule extra care or refill prescriptions before those amounts reset.

Be wary of Medicare scams. As the year wraps up, there’s often a spike in fraudulent calls or mail related to Medicare. Keep in mind that Medicare will never call you asking for personal or financial information. Staying vigilant can help safeguard your identity and benefits.

In short, the end of the year is an ideal time for Medicare beneficiaries to review their coverage, understand any upcoming changes, and make the most of available benefits. With a little planning now, you can kick off the new year feeling confident that your coverage aligns with your health needs and budget.

If you need assistance with Medicare, you can reach out by calling 1-800-Medicare (1-800-633-4227), visiting Medicare.gov, or getting in touch with your local State Health Insurance Assistance Programs (SHIP). For extra help, don’t hesitate to contact the Office for Aging Services and NY Connects. You can drop by one of our office locations, shoot us an email at ccnyc@chqgov.com, or give us a ring at 716-753-4582.