When you visit a doctor or hospital, your out-of-pocket cost often depends on whether your provider is participating or non-participating with your health insurance plan. Simply put:

- Participating providers (also known as in-network) have a contract with your insurance and agree to accept negotiated rates.

- Non-participating providers (out-of-network) do not have a contract, which can mean higher costs for you.

Understanding the difference can save you money and stress—especially when unexpected medical bills appear.

Participating Providers: What You Get

These providers have signed agreements with insurance companies. This benefits both the patient and the provider:

- Lower out-of-pocket costs due to agreed-upon fees

- Streamlined billing (the provider files the claim for you)

- Guaranteed coverage for services under your plan

- Consistent care access through provider networks

This helps ensure predictable costs and easier care coordination.

Non-Participating Providers: What You Risk

While you can still see a non-participating provider, it often comes at a cost:

- Higher out-of-pocket expenses

- Balance billing (you may owe the difference between what the provider charges and what insurance pays)

- More paperwork (you might have to file your own claim)

- Potential denial of coverage for non-emergency services

This can be a barrier to affordable care and equal access to care, especially under plans like those offered through the Affordable Care Act.

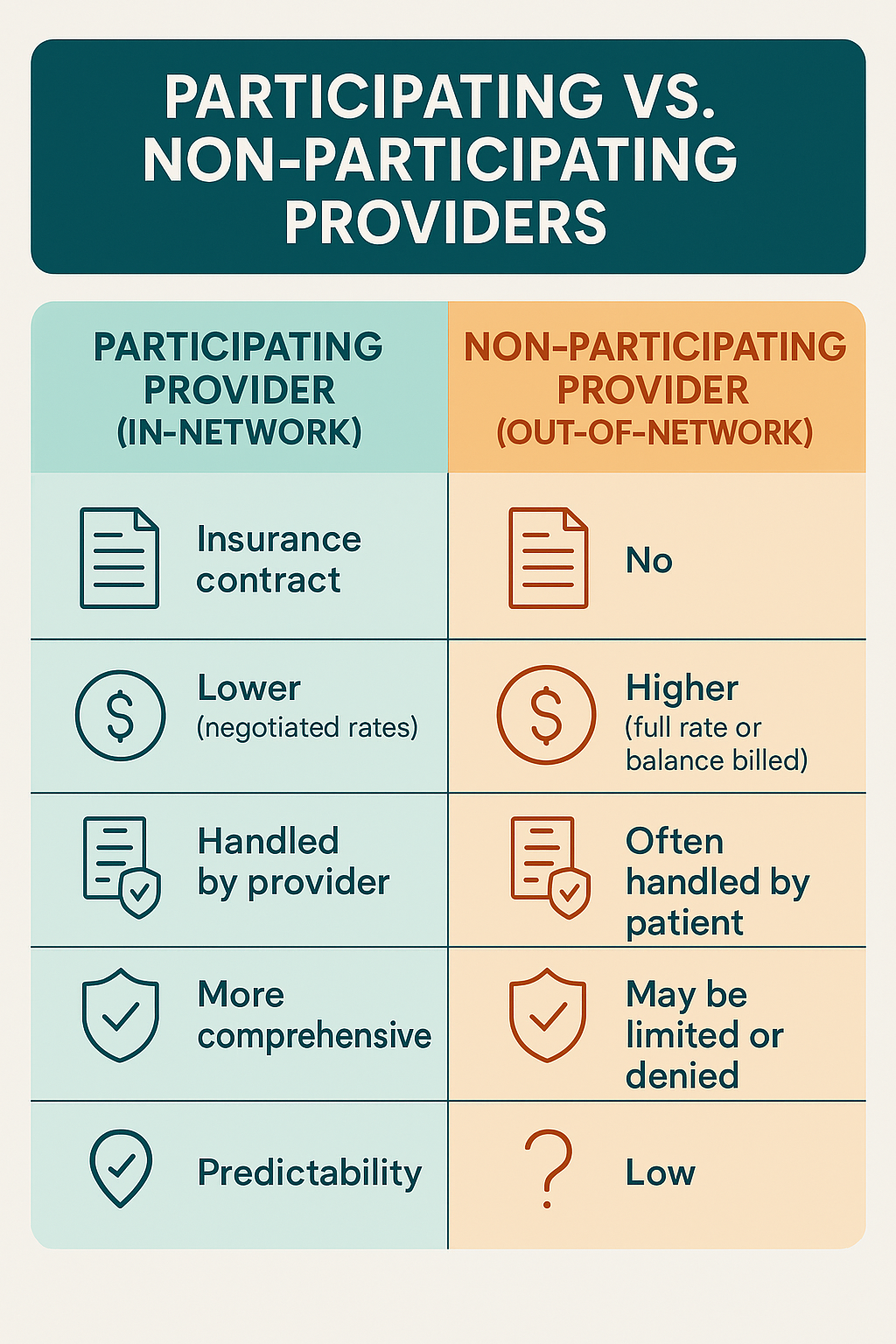

Key Differences at a Glance

Here’s a quick comparison:

| Feature | Participating Provider (In-Network) | Non-Participating Provider (Out-of-Network) |

|---|---|---|

| Insurance Contract | Yes | No |

| Cost to Patient | Lower (negotiated rates) | Higher (full rate or balance billed) |

| Billing Process | Handled by provider | Often handled by patient |

| Insurance Coverage | More comprehensive | May be limited or denied |

| Predictability | High | Low |

Why It Matters to You

Choosing a participating provider can:

- Help manage healthcare costs

- Improve access to care

- Reduce surprise bills

- Support better care coordination

If you’re unsure whether a provider is participating, call your insurance company or check the online provider directory before booking an appointment.

Final Thoughts: Choose Smart, Stay Covered

Whether you’re managing chronic care or just planning your next check-up, knowing the difference between participating and non-participating providers empowers you to make smarter financial and health decisions. With rising healthcare costs, it’s more important than ever to understand how provider networks work—and how they impact your wallet.