A deductible is the amount you pay for covered medical care before your insurance starts sharing the cost. It affects your bills, your budget, and the plan you choose. Once you know how it works, you can make smarter healthcare decisions and avoid surprise charges.

Glossary

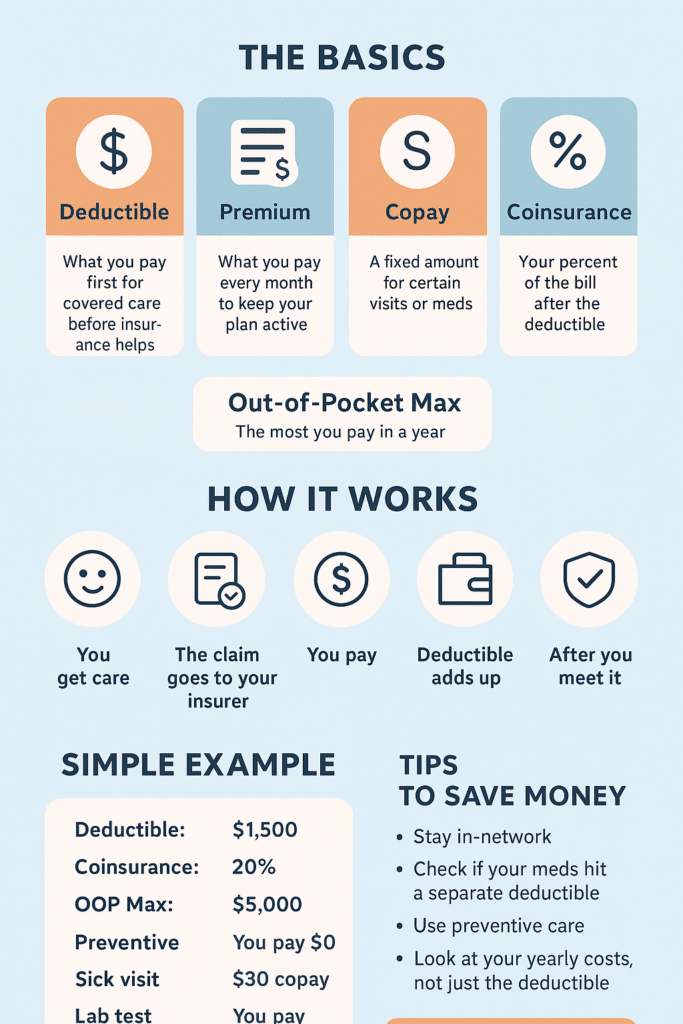

Premium: What you pay every month to keep your insurance active.

Deductible: What you pay first for covered care before your plan helps with the bill.

Copay: A fixed amount you pay for certain visits, like a 30 dollar fee for a doctor visit.

Coinsurance: Your percentage of a bill after the deductible.

Out-of-pocket maximum: The most you will pay in a year for covered care.

Allowed amount: The discounted price your insurer sets for a service.

In-network: Providers that have a contract with your insurance. They cost less.

Out-of-network: Providers with no contract. They cost more and may not count toward your deductible.

Introduction

Understanding your deductible matters. It shapes how much you pay when you get care and helps you pick the right plan for your budget. This guide explains what a deductible is, how it works in real life, and how you can make better choices when comparing plans.

What is a Deductible?

A deductible is the amount you pay for covered healthcare services before your health insurance starts to share the cost. Until you reach this amount, you generally pay the full “allowed amount” for care. There are exceptions for some services, like many preventive services or certain copays.

Why are Deductibles Important?

Understanding your deductible is key. It influences:

- How much you pay when you get care

- Your healthcare budget

- Which insurance plan best fits you

A smart choice can save you hundreds or even thousands of dollars each year.

Understanding Deductibles in Health Insurance: A Comprehensive Guide

Key Health Insurance Terms

- Premium: What you pay each month to keep coverage.

- Deductible: The amount you pay first for covered services before the plan pays (with exceptions).

- Copayment (copay): A flat fee (for example, $30) for certain services or prescriptions. This may or may not apply before the deductible, depending on your plan.

- Coinsurance: Your percentage share of costs after the deductible (for example, 20%).

- Out-of-pocket (OOP) maximum: The most you’ll pay in a plan year for in-network covered services. After you hit it, the plan pays 100% for the rest of the year.

- Network: In-network providers have contracted rates; out-of-network costs are usually higher and may have separate deductibles and OOP maximums.

The Role of Deductibles

Deductibles shift some upfront costs to you, which often lowers premiums. They help prevent overuse of medical services while capping your risk through the OOP maximum.

Why It Matters

Financial Implications for Policyholders

Your total annual cost equals:

- Premiums

- Out-of-pocket spending on care

A higher deductible may mean lower premiums but higher costs when you need care.

Impact on Healthcare Access and Decision-Making

Knowing your progress toward your deductible can influence:

- When you schedule procedures

- Whether you shop around in-network

- How you plan for prescriptions and imaging

Connection Between Deductibles and Premium Costs

Generally:

- Higher deductible = lower premium

- Lower deductible = higher premium

The right trade-off depends on your expected use and risk tolerance.

Role of Deductibles in Health Insurance

How Deductibles Fit Into the Insurance Plan Structure

- Individual vs. Family: Family plans usually have both individual and family deductibles.

- Embedded: Each person has an individual deductible.

- Aggregate: The whole family must meet one combined deductible.

- Medical vs. Pharmacy: Some plans have separate deductibles for prescriptions; others combine them.

- Plan Year vs. Calendar Year: Most plans reset annually—know your plan’s reset date.

- In-Network vs. Out-of-Network: Often separate (and higher) deductibles and OOP maximums for out-of-network care.

Comparison with Other Cost-Sharing Mechanisms

- Deductible: You pay first for covered services.

- Copay: A flat fee per service; may apply before the deductible on some services.

- Coinsurance: Percentage you pay after the deductible.

- OOP Maximum: A safety net—once reached, the plan pays 100% for covered in-network services for the rest of the plan year.

What You Need to Know

Key Terms Related to Deductibles

- Out-of-pocket maximum: Includes your deductible, copays, and coinsurance for in-network services. Premiums do not count toward it.

- In-network vs. Out-of-network: In-network care is usually cheaper and counts toward in-network accumulators. Out-of-network may have separate (higher) accumulators and balance billing risks.

- Allowed Amount: The negotiated price your insurer recognizes.

- Explanation of Benefits (EOB): A statement showing what was billed, the allowed amount, what the plan paid, and what you owe.

Common Misconceptions About Deductibles

- “Preventive care applies to the deductible.” Typically, in-network preventive care is $0 and does not count toward your deductible.

- “Once I meet the deductible, everything is free.” Often, you still pay coinsurance or copays until you hit the OOP max.

- “Copays always count toward the deductible.” Not always; they usually count toward the OOP max.

- “All services hit the same deductible.” Some plans have separate medical vs. pharmacy deductibles.

- “In-network and out-of-network share the same deductible.” Usually, they are separate.

What Is a Deductible and How Does It Work?

Detailed Definition of a Deductible

The deductible is what you pay for covered services before your plan shares costs. Some services may be covered before the deductible.

Step-by-Step Explanation of How Deductibles Work

- You get care.

- The provider bills your insurer.

- The insurer applies the plan rules: checks network status, allowed amount, deductible remaining, copays, and coinsurance.

- You receive an EOB showing what you owe (this could be a copay, an amount applied toward deductible, coinsurance, or $0 for preventive care).

- Your deductible “accumulator” increases until you meet it. After that, coinsurance/cops apply until you reach your OOP maximum.

A Clear Explanation

Examples of Different Deductible Amounts and Their Implications

- Low Deductible Plan: Higher premiums; lower cost at the point of care. Better if you expect frequent care or have a planned procedure.

- High Deductible Plan (often HSA-eligible): Lower premiums; you pay more upfront until you meet the deductible. Better if you expect low to moderate use and can cover a larger bill if needed.

Scenarios Illustrating How Deductibles Affect Costs

Example plan (illustrative only):

- $1,500 in-network deductible

- 20% coinsurance after deductible

- $5,000 OOP max

- $30 primary care copay not subject to deductible

Examples:

- Preventive Checkup (allowed $300): You pay $0; plan pays $300.

- Sick Visit (allowed $150): You pay $30; plan pays $120.

- Lab (allowed $250): You pay $250; deductible used: $250.

- MRI (allowed $1,200): You pay $1,200 to the deductible. Deductible used: $1,450.

- Outpatient Procedure (allowed $12,000): You pay $50 then 20% coinsurance on the rest.

Importance of Deductibles in Health Insurance

Role in Managing Healthcare Expenses

Deductibles let you trade lower premiums for higher upfront costs, capping your worst-case scenario with an OOP maximum.

Influence on Insurance Plan Selection and Budgeting

If you expect high usage, a lower deductible can protect your cash flow. If you expect low usage, a higher deductible plan may save money overall.

Essential Information for Policyholders

Tips for Choosing the Right Deductible

- Estimate your likely care: Consider routine meds, specialist visits, and planned procedures.

- Do the math: Compare annual premium differences vs. expected out-of-pocket costs.

- Check HSA eligibility: HSA-qualified plans offer tax advantages.

- Review pharmacy rules: Check if there’s a separate drug deductible.

- Confirm network and referrals: Staying in-network helps control costs.

- Look at accumulators: Understand individual vs. family limits.

- Cash reserve: Ensure you can cover a sudden bill if you choose a higher deductible.

Understanding Your Policy and Deductible Terms

- Read the Summary of Benefits and Coverage (SBC).

- Review the plan booklet for details on coverage.

- Track your accumulators in your insurer’s portal or app.

Resources for Further Information

- Your insurer’s member portal and customer service.

- Employer HR/benefits team or broker.

- Healthcare.gov or your state marketplace.

- Your state Department of Insurance for independent help.

Real-Life Stories

Story 1: The Parent at Urgent Care

Julia takes her son to urgent care with a fever. Her plan has a 50 dollar urgent care copay that does not hit the deductible. She pays the 50 dollars and leaves. The deductible stays untouched.

Story 2: The Planned Surgery

Chris has surgery scheduled in March. He plans his follow-up imaging in June so that it falls in the same year. After meeting his deductible early, all the later tests only require coinsurance. He saves a lot by timing it right.

Conclusion

Significance of Deductibles

Deductibles determine what you pay first and how quickly your plan starts sharing costs.

Evaluate Your Health Insurance Needs

Consider your expected care, medications, cash flow, and risk tolerance. Then compare total costs, not just premiums.

Making Informed Decisions

The best plan fits your health needs and budget. Use your SBC, ask questions, and revisit your choice each year.

For Scenarios related to deductibles click on pdf.

Deductibles.pdf