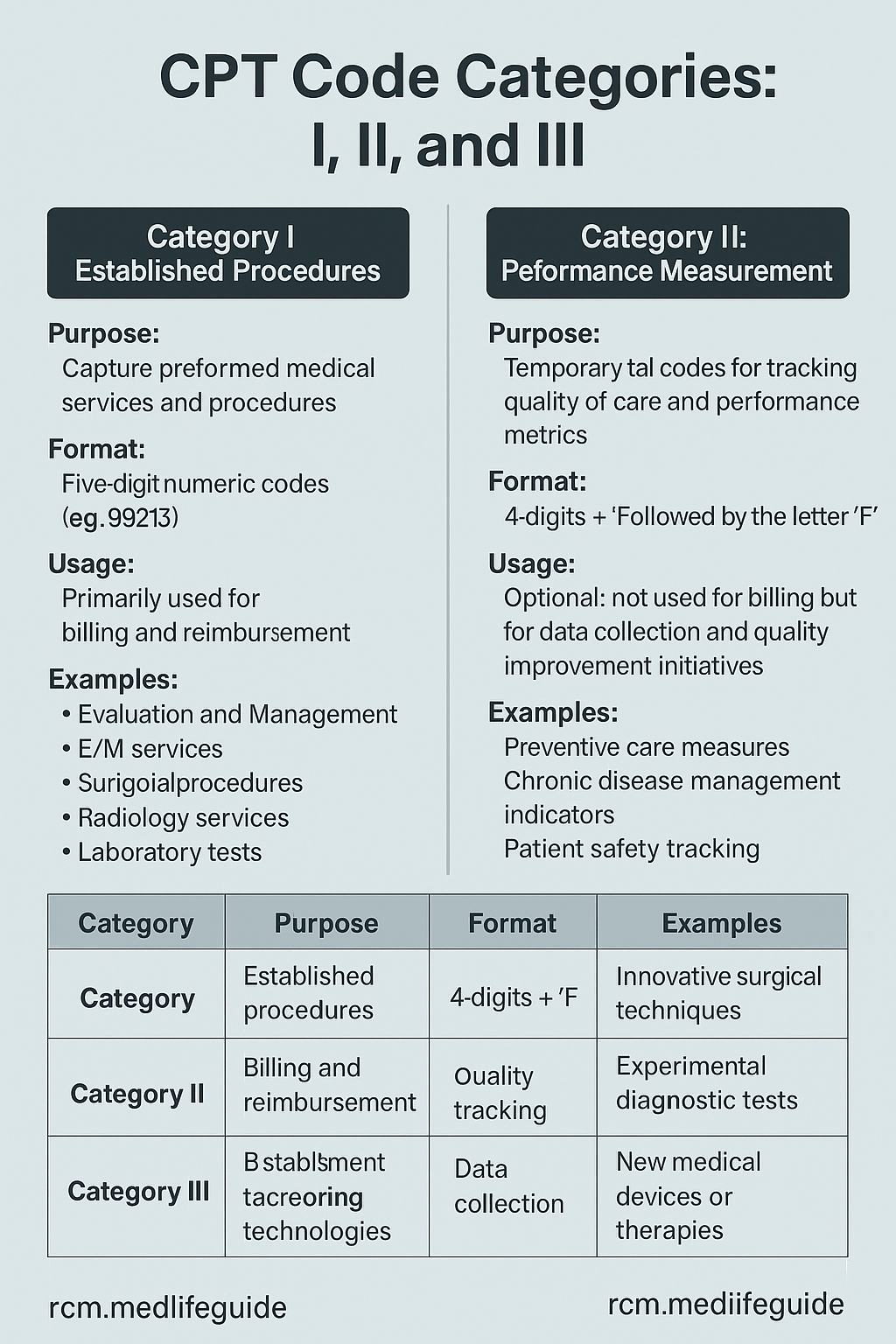

- Category I: Standard codes for common procedures (e.g., office visits, surgeries).

- Category II: Optional tracking codes for quality and performance metrics.

- Category III: Temporary codes for emerging technologies and experimental treatments.

Understanding these distinctions ensures accurate billing, compliance, and maximum reimbursements.

1. CPT Category I Codes: The Foundation of Medical Billing

Purpose: Used for established medical, surgical, and diagnostic services.

Examples:

- 99213 (Office visit for an established patient)

- 93000 (Electrocardiogram)

Why They Matter:

✔ Required for insurance claims.

✔ Directly tied to reimbursements.

✔ Updated annually by the American Medical Association (AMA).

Common Challenges:

- Incorrect coding leads to claim denials.

- Requires ongoing training due to yearly updates.

2. CPT Category II Codes: Tracking Quality & Performance

Purpose: Supplemental codes for measuring healthcare quality (e.g., preventive care, chronic disease management).

Examples:

- 2024F (Documentation of HbA1c test for diabetes)

- 3014F (Tobacco use assessment)

Why They Matter:

✔ Supports value-based care (e.g., MIPS, Pay-for-Performance).

✔ Helps avoid penalties under Medicare rules.

Key Consideration:

- Not used for billing but improves practice performance metrics.

3. CPT Category III Codes: For Emerging Technologies

Purpose: Temporary codes for new and experimental procedures.

Examples:

- 0346T (Transcatheter mitral valve repair)

- 0492T (AI-assisted radiology analysis)

Why They Matter:

✔ Facilitates adoption of innovative treatments.

✔ Helps gather data for future Category I approval.

Limitations:

- Often not reimbursed immediately.

- Used primarily for research and data collection.

| Category | Description | Examples |

|---|---|---|

| Category I | Most commonly used codes for established medical procedures and services. | 99213 (Office visit), 93000 (EKG) |

| Category II | Optional tracking codes for performance measurement and quality reporting. | 2024F (Diabetes HbA1c test documented) |

| Category III | Temporary codes for emerging technologies and experimental procedures. | 0346T (Transcatheter mitral valve repair) |

2. Detailed Breakdown of CPT Categories

A. CPT Category I Codes

- Purpose: Billing for widely performed medical, surgical, and diagnostic services.

- Structure: 5-digit numeric codes (e.g., 99214 for an established patient office visit).

- Coverage: Recognized by Medicare and private insurers.

- Importance in Billing:

- Essential for claim submissions.

- Directly impacts reimbursement.

B. CPT Category II Codes

- Purpose: Tracking quality measures (e.g., preventive care, chronic disease management).

- Structure: Alphanumeric, ending with “F” (e.g., 3014F for tobacco use assessment).

- Coverage: Not used for billing but supports Pay-for-Performance (P4P) and MIPS (Merit-Based Incentive Payment System) reporting.

- Importance in Billing:

- Helps avoid penalties under value-based care models.

- Improves practice performance metrics.

C. CPT Category III Codes

- Purpose: Temporary codes for emerging treatments and technologies.

- Structure: 4 digits followed by “T” (e.g., 0492T for AI-assisted radiology).

- Coverage: Often not reimbursed immediately; used for data collection.

- Importance in Billing:

- Facilitates adoption of new medical advancements.

- Helps gather data for future Category I inclusion.

How to Use CPT Codes Correctly

- Verify Codes Annually – CPT updates occur yearly.

- Use AI Coding Tools – Reduces errors in claims processing.

- Train Staff Regularly – Ensures compliance with Medicare and HIPAA rules.

Need Help with Medical Billing?

Outsourcing to a medical billing service ensures:

✔ Fewer claim denials.

✔ Proper use of Category I, II, and III codes.

✔ More time to focus on patient care.