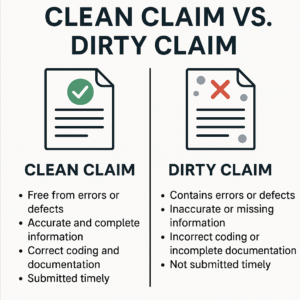

In medical billing, the terms “clean claim” and “dirty claim” are more than just jargon, they directly affect how quickly healthcare providers get paid. A clean claim is one that is accurately completed, properly coded, and submitted in compliance with the payer’s guidelines. It processes smoothly and typically results in timely payment. A dirty claim, by contrast, contains errors or omissions that cause delays, denials, or the need for manual intervention. Understanding the differences and how to minimize dirty claims is essential for maintaining a healthy revenue cycle.

Top Reasons Claims Are Marked as Dirty

Dirty claims are flagged by insurance companies for various issues that prevent them from being processed correctly. These can stem from human error, system glitches, or lack of updated payer requirements. Some top causes include:

- Incorrect patient demographics: Spelling errors, wrong date of birth, or mismatched insurance ID numbers.

- Invalid procedure or diagnosis codes: Outdated CPT, ICD-10, or HCPCS codes that do not match payer policies.

- Missing documentation: Lack of medical necessity, prior authorizations, or operative reports.

- Coding mismatches: For example, a gender-specific diagnosis for a patient of the opposite sex.

- Timely filing issues: Claims submitted outside the payer’s required time frame.

Dirty claims often result in rejections or denials, each requiring research, corrections, and resubmission.

Clean Claim vs Dirty Claim Comparison

The table below highlights the fundamental differences between clean and dirty claims:

| Feature | Clean Claim | Dirty Claim |

|---|---|---|

| Accuracy | Fully accurate, verified data | Contains errors or missing information |

| Documentation | Complete and in compliance | Incomplete or incorrect |

| Timeliness | Submitted within filing deadlines | Often delayed or late |

| Reimbursement | Prompt payment | Delays or denials, requiring follow-up |

| Labor Effort | Minimal administrative effort | Requires additional staff time and resources |

| Denial Risk | Low | High |

| Revenue Impact | Positive cash flow, faster collections | Cash flow disruption, increased A/R days |

How to Avoid Dirty Claims in Healthcare

Preventing dirty claims is not just about data accuracy—it involves a combination of staff training, technology, and workflows:

- Use real-time eligibility tools: Verify insurance coverage at the time of service.

- Implement coding software or AI-assistants: Helps catch mismatches or outdated codes before submission.

- Standardize intake processes: Collect consistent, complete patient and insurance information.

- Train billing staff: Regularly update knowledge on payer-specific requirements and common denial trends.

- Use claim scrubbers: These pre-submission tools flag potential issues before a claim is sent.

- Audit regularly: Internal audits help catch systemic errors and improve overall accuracy.

Investing in prevention leads to better financial performance and patient satisfaction.

Clean Claim Processing Time vs Dirty Claim

Clean claims are typically processed within 7 to 14 business days, depending on the payer. Electronic claims may be reimbursed even faster—within 3 to 5 days. Dirty claims, however, can take 30 to 90 days or longer to resolve, especially if the payer requests additional documentation or appeals are required.

Processing Time Comparison Chart:

| Claim Type | Average Processing Time |

| Clean Claim | 7–14 business days |

| Dirty Claim | 30–90+ days |

The longer a claim remains unpaid, the higher the administrative burden and the greater the risk of revenue loss.

Impact of Dirty Claims on Revenue Cycle

Dirty claims significantly disrupt the revenue cycle, which is the lifeline of any healthcare organization. Consequences include:

- Delayed reimbursements: Slows down cash inflow needed for day-to-day operations.

- Increased A/R days: More outstanding balances remain unpaid for longer periods.

- Higher administrative costs: Staff spend additional time correcting and resubmitting claims.

- Lower provider satisfaction: Reimbursement frustrations can affect morale and retention.

- Patient dissatisfaction: Confusing or incorrect bills reduce trust and loyalty.

Even a small percentage of dirty claims can snowball into large financial problems if not addressed quickly.

Clean Claim Submission Guidelines

To consistently submit clean claims, follow these best practices:

- Collect accurate patient data: Double-check names, dates of birth, insurance IDs, and contact info.

- Verify eligibility: Use electronic tools to confirm active coverage before services are rendered.

- Stay updated on coding rules: Monitor changes to CPT, ICD-10, and HCPCS codes annually.

- Match documentation to coding: Ensure medical records justify all billed procedures.

- Submit within time limits: Know the payer’s deadlines—some are as short as 90 days.

- Use clearinghouses or EHR integrations: Streamline and automate clean claim checks.

Consistency in applying these steps builds a foundation for fewer denials and faster payment.

Common Errors That Make a Claim Dirty

Many dirty claims stem from recurring errors. The most common include:

- Incorrect patient demographics

- Missing or invalid insurance details

- Incorrect or outdated procedure/diagnosis codes

- Missing modifiers or incorrect POS (Place of Service) codes

- Failure to include required documentation

- Not meeting medical necessity requirements

Recognizing these patterns allows billing teams to take preventive action.

How to Correct a Dirty Claim

When a claim is returned or denied, take these steps to correct it quickly:

- Review the explanation of benefits (EOB): Identify the denial reason code.

- Investigate the root cause: Was it a data entry error, coding issue, or missing documentation?

- Correct the issue: Edit the claim details, attach documents if needed.

- Resubmit promptly: Don’t let deadlines pass while waiting to fix issues.

- Track and follow up: Monitor resubmitted claims until payment is confirmed.

Timely correction and resubmission prevent permanent write-offs and improve recovery rates.

Clean Claim vs Dirty Claim in Medical Billing

In the medical billing world, the difference between clean and dirty claims is critical. Clean claims are the gold standard—they are quickly paid, require no follow-up, and improve overall revenue cycle efficiency. Dirty claims, by contrast, create financial and operational burdens.

Investing in staff training, robust software, and clear processes can significantly increase your clean claim rate and reduce the risks and costs associated with dirty claims. In today’s value-driven healthcare environment, accuracy in billing is no longer optional—it’s essential.

Key Takeaways

- A clean claim is accurate, complete, and promptly reimbursed.

- A dirty claim has errors and requires rework, delaying payment.

- Common dirty claim causes include incorrect codes, missing documentation, and data entry mistakes.

- Proactively avoiding errors saves time, money, and improves cash flow.

- Regular audits, staff training, and technology tools are key to maintaining clean claims.

FAQs

Q1: What qualifies as a clean claim?

A clean claim is one that is submitted with complete, correct information, within the payer’s filing timeline, and requires no additional documentation or corrections.

Q2: Can a claim be turned from dirty to clean?

Yes. Dirty claims can be corrected and resubmitted with the required changes, documentation, or clarifications to become eligible for payment.

Q3: What’s the industry benchmark for clean claim rates?

An efficient billing department should aim for a clean claim rate of 95% or higher. Anything lower may indicate systemic issues that need attention.