Medical billing is a vital part of the healthcare revenue cycle that ensures healthcare providers are reimbursed for the services they offer. For professionals and patients alike, understanding the terminology used in this field is essential. Whether you’re a medical billing specialist, a healthcare provider, or just someone trying to understand a bill, learning the basic terms can help demystify the process.

Below is a detailed breakdown of the most commonly used medical billing terms, explained in simple language.

1. Claim

A claim is a formal request submitted to a health insurance company for payment of medical services provided. Once a patient receives treatment, the provider prepares and sends a claim with the relevant codes and charges to the payer (insurance company).

Example: After a patient’s visit, the clinic sends a claim to their insurance for reimbursement.

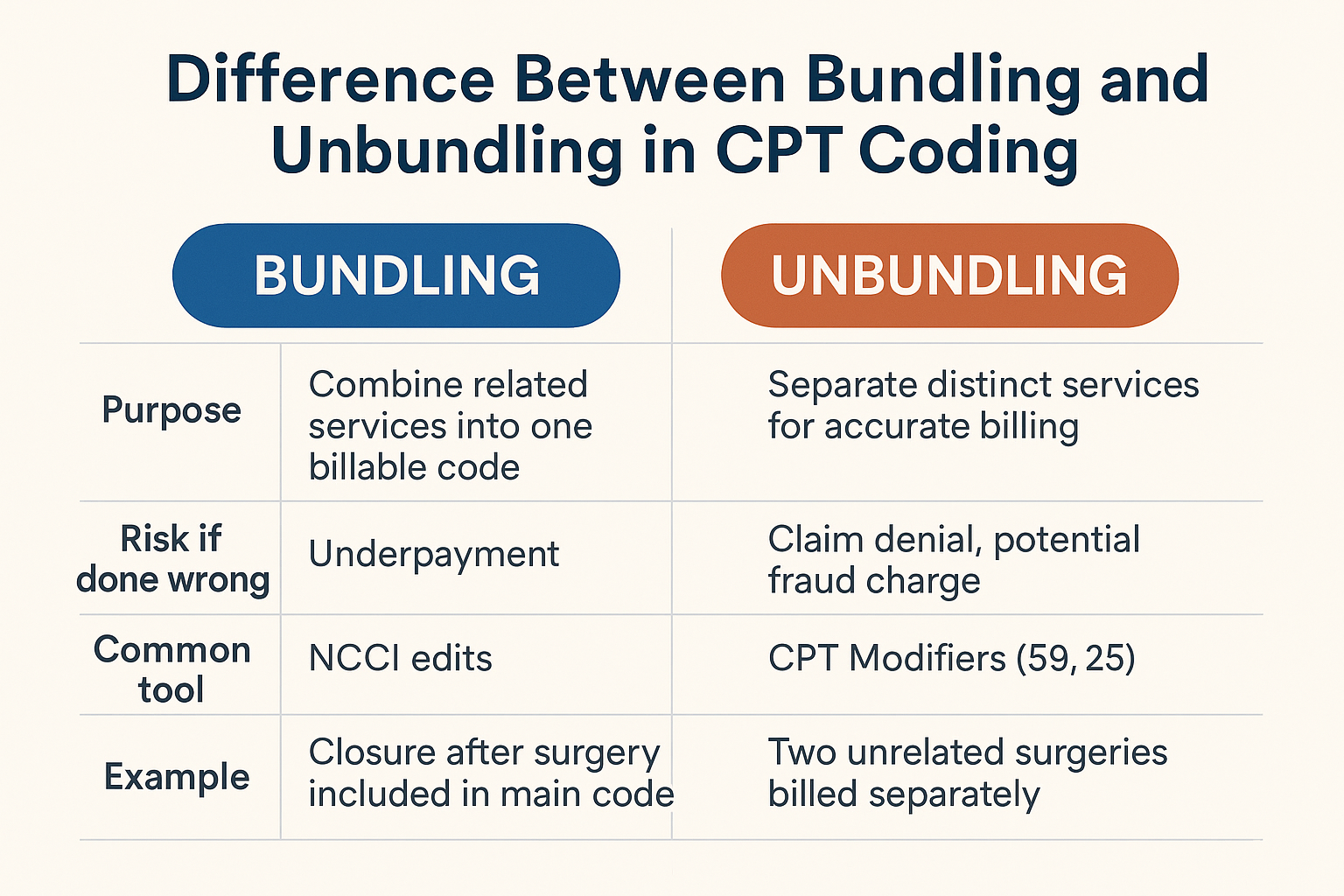

CPT Codes (Current Procedural Terminology)

These codes describe the medical procedures and services provided by healthcare professionals. Maintained by the American Medical Association (AMA), CPT codes ensure uniform documentation and billing across providers.

Example: A CPT code like 99213 might represent a 15-minute office visit.

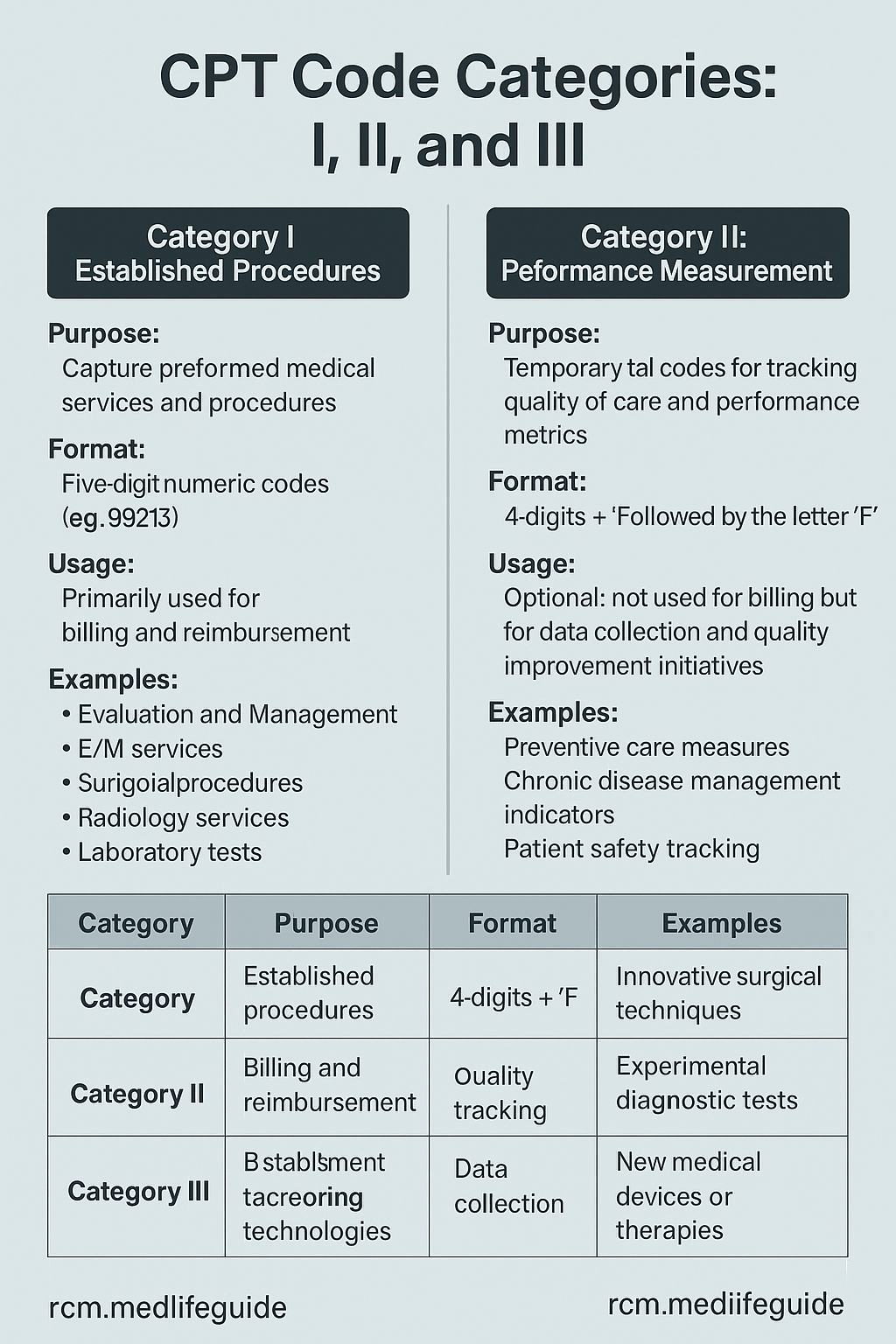

There are three categories of CPT code.

- Category I: Standard codes for common procedures (e.g., office visits, surgeries).

- Category II: Optional tracking codes for quality and performance metrics.

- Category III: Temporary codes for emerging technologies and experimental treatments.

For more details click here

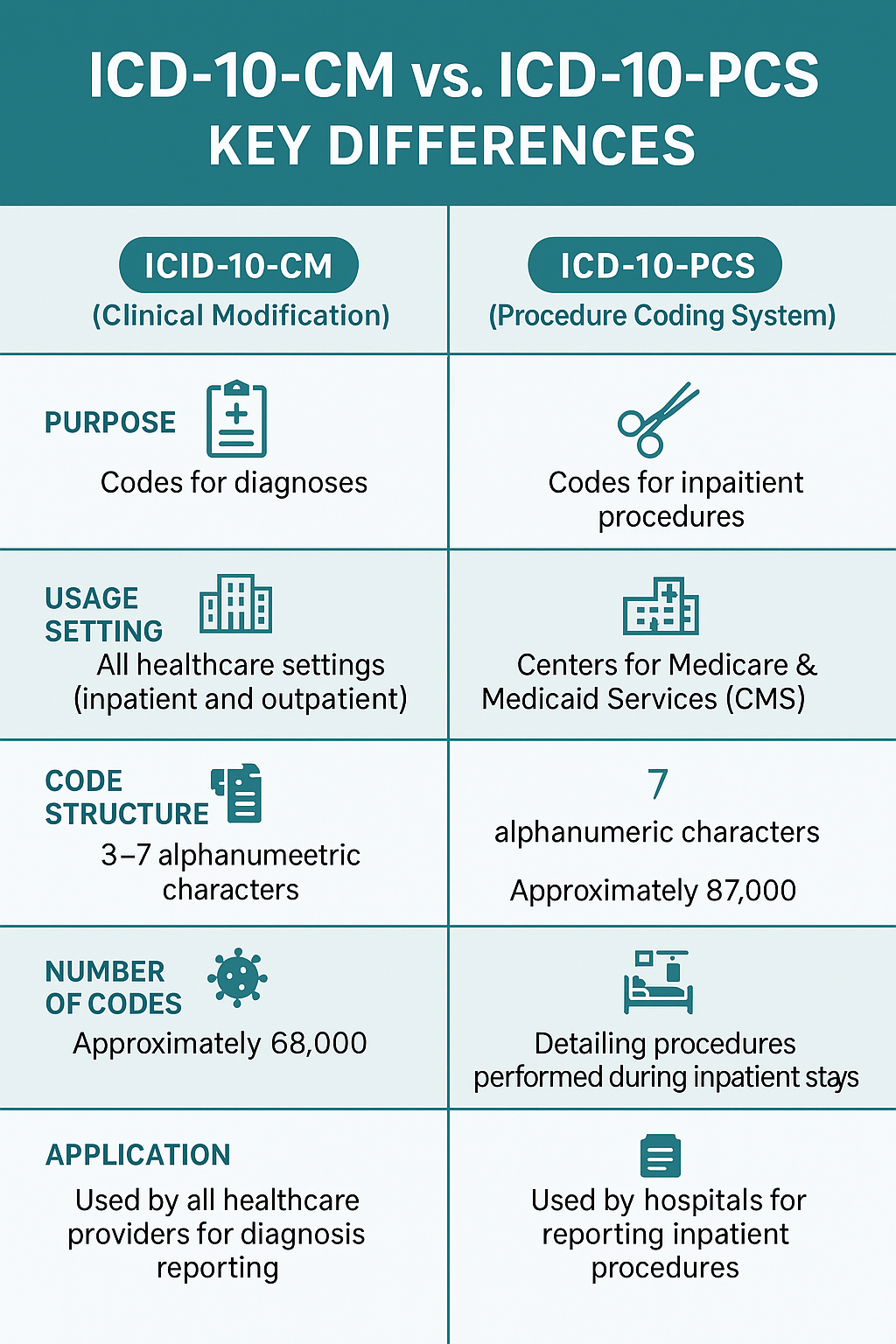

ICD Codes (International Classification of Diseases)

ICD codes are used to identify diagnoses and conditions. They help insurance companies understand why a service was provided. The current version in use in the U.S. is ICD-10-CM.

Example: E11.9 is the ICD-10 code for Type 2 Diabetes without complications.

HCPCS Codes (Healthcare Common Procedure Coding System)

These codes cover non-physician services and items not included in CPT codes, like durable medical equipment, prosthetics, ambulance services, etc.

Example: A0429 is the HCPCS code for basic ambulance transport.

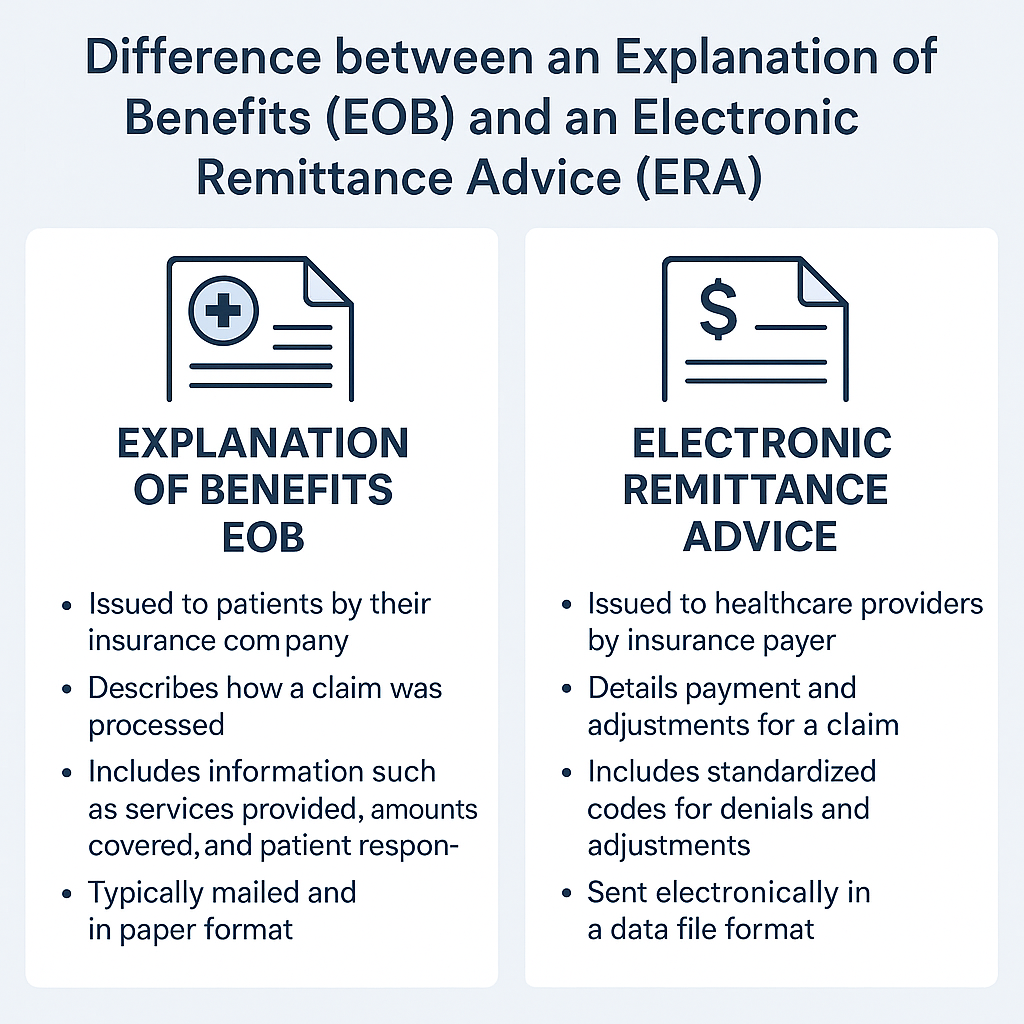

EOB (Explanation of Benefits)

An EOB is a document sent by the insurance company to the patient and provider. It outlines what was billed, how much was covered, how much was denied, and the patient’s financial responsibility.

Note: This is not a bill, but it provides essential billing details.

ERA (Electronic Remittance Advice)

The ERA is the electronic version of the EOB. It automates payment posting by detailing claim payments, adjustments, and denials.

Deductible

A deductible is the fixed annual amount a patient must pay out-of-pocket before insurance coverage begins to pay for services.

Example: If a plan has a $1,000 deductible, the patient pays the first $1,000 of medical costs each year.

Copayment (Copay)

A copayment is a flat fee paid by the patient at the time of service. It is usually required for routine visits, such as seeing a primary care doctor or filling a prescription.

Example: A $25 copay for each doctor’s visit.

Coinsurance

Coinsurance is the percentage of medical costs a patient shares with the insurance company after the deductible is met.

Example: With 80/20 coinsurance, the insurance pays 80%, and the patient pays 20%.

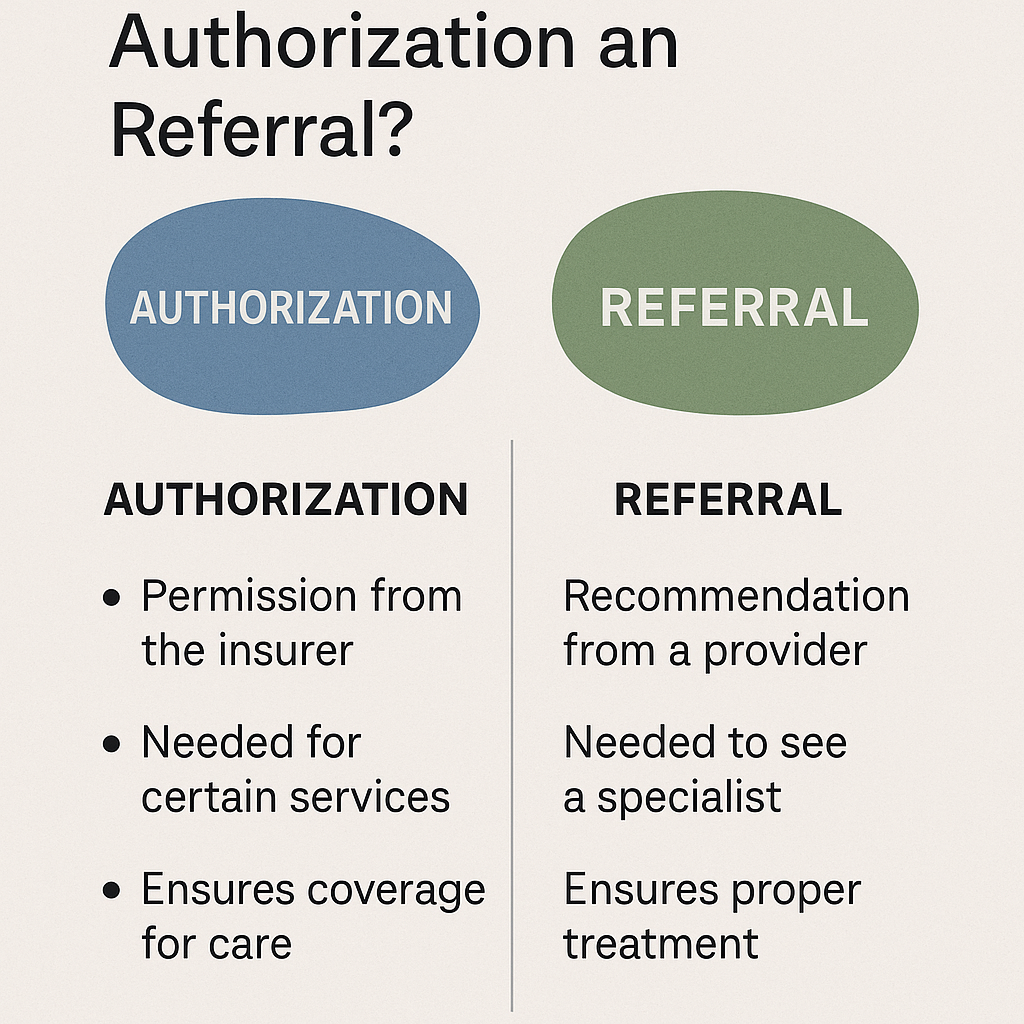

Prior Authorization

Some services require prior authorization (pre-approval) from the insurance company to confirm that the treatment is medically necessary before it will be covered.

Example: MRI scans, surgeries, and specialist treatments often require prior authorization.

Medical Necessity

This term indicates that a service or treatment is clinically appropriate and necessary for a patient’s condition. Insurance companies use this to determine coverage eligibility.

Payer

A payer is the entity responsible for reimbursing the provider. This could be a private insurance company, Medicare, Medicaid, or another third-party insurer.

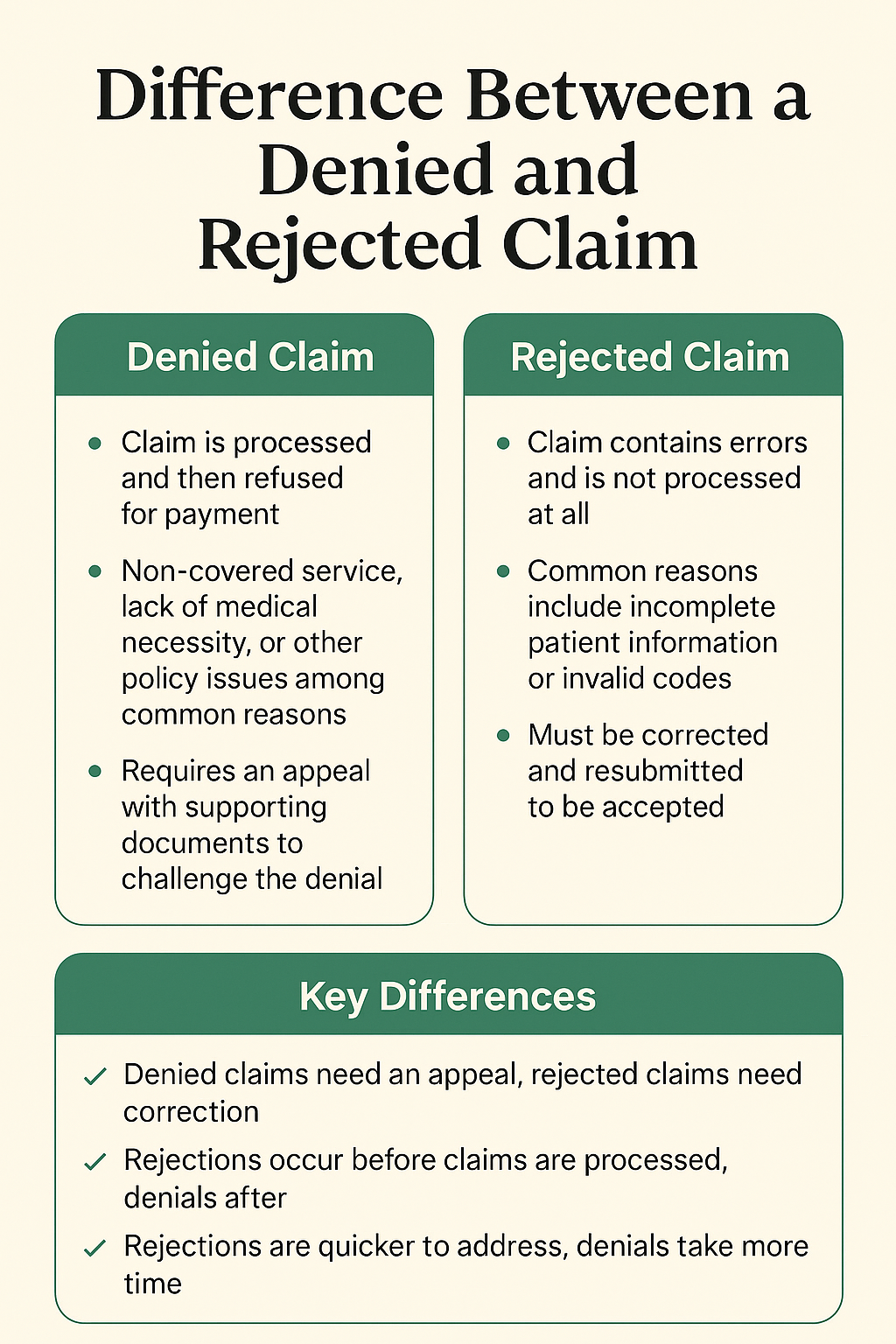

Denial

A denial happens when a claim is rejected by the insurance company. Denials can occur due to coding errors, missing information, lack of coverage, or lack of medical necessity.

For denial code list and their description click here

Appeal

If a claim is denied or underpaid, providers or patients can file an appeal. This is a formal request for the payer to review and reconsider the claim decision.

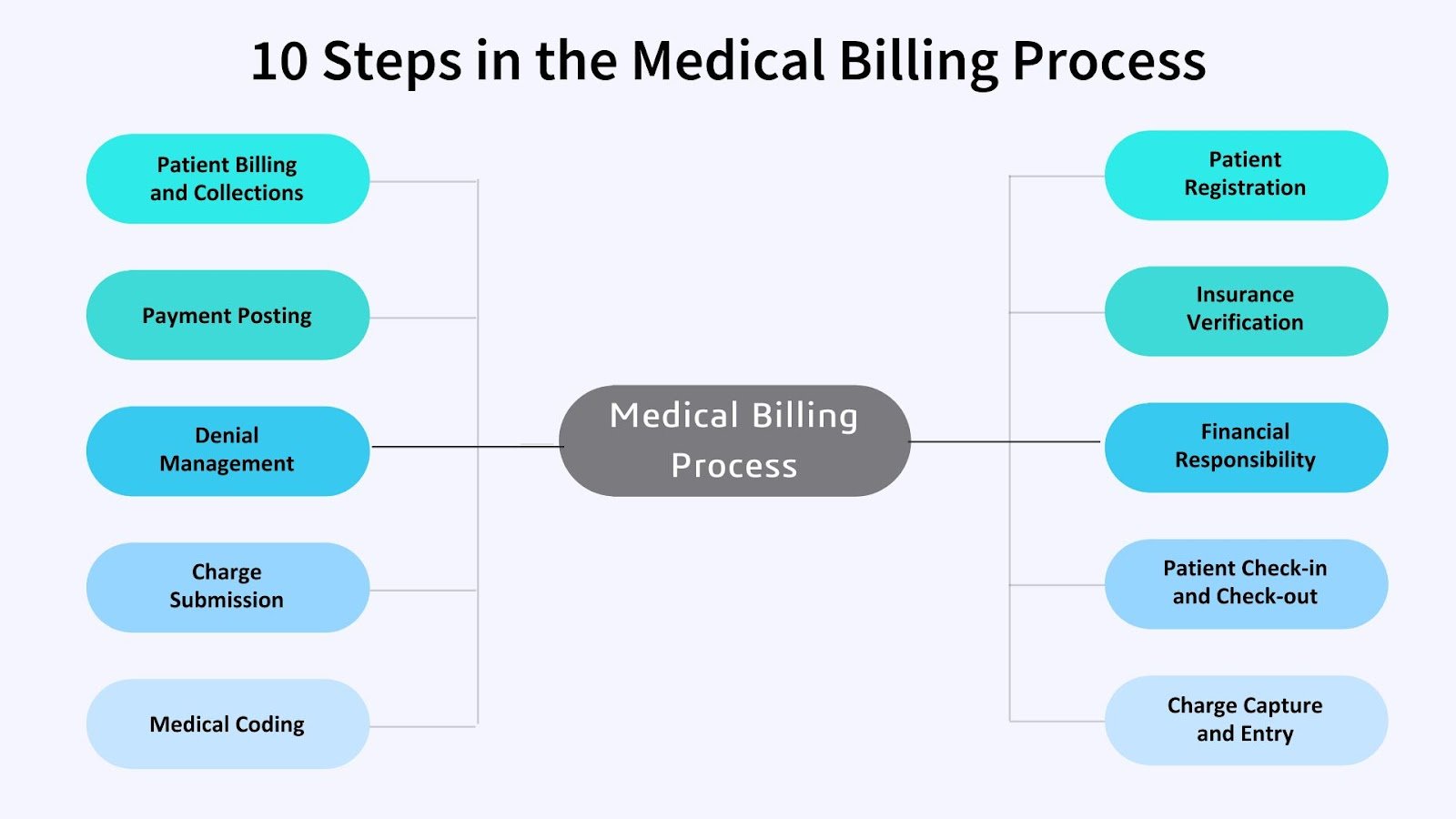

Revenue Cycle

The revenue cycle refers to the entire financial process in healthcare—from the moment a patient schedules an appointment until the final payment is collected. It includes verifying insurance, coding, billing, collections, and reporting.