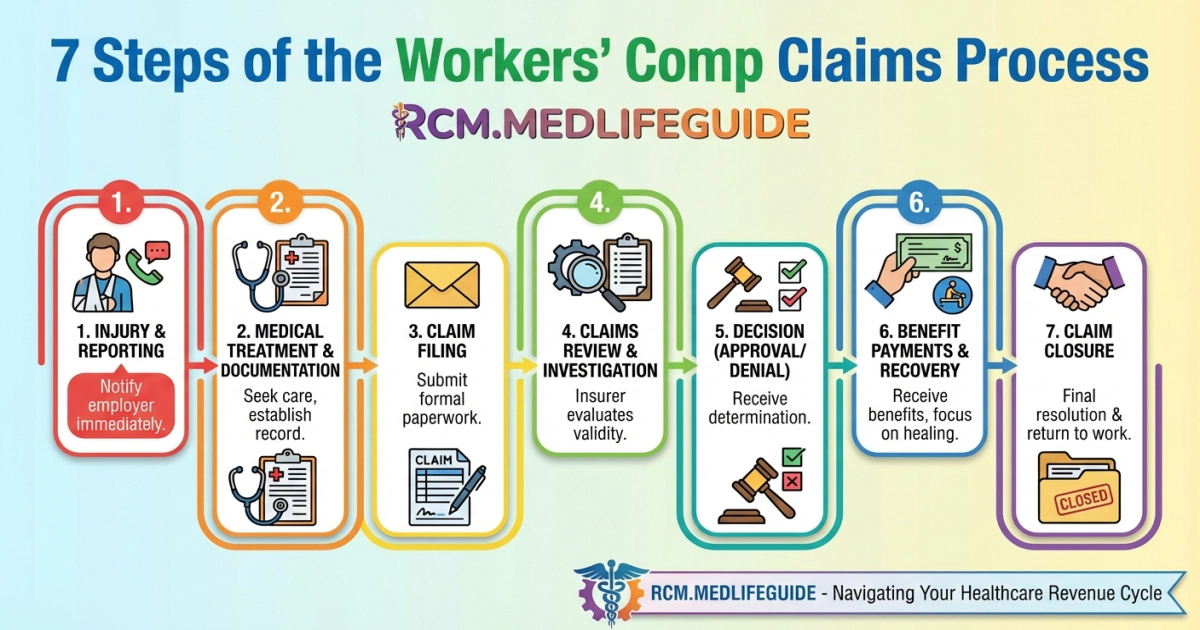

Lets explain the workers’ comp claims process in 7 critical steps so you can win your claim. We show when to report an injury, how to file a claim, and how to get medical and wage loss benefits.

We also cover the claims adjuster review, employer duties, documentation needs, appeals, settlements, and return-to-work plans. Follow our guide to protect your rights and speed your recovery.

Key Takeaways

- Report any work-related injury to your supervisor immediately (often within 30 days) and get authorized medical care to protect your claim.

- Obtain and accurately complete required claim forms and make sure your employer files the Initial Report of Injury and notifies the insurer quickly.

- The insurer will investigate and issue a Notice of Decision accepted claims trigger medical and wage-replacement benefits while denials require prompt action.

- Keep thorough documentation (medical records, photos, witness statements, communications) and follow treatment to Maximum Medical Improvement to support your case and settlement value.

- If a claim is denied or disputed, file appeals within deadlines and consult a workers’ comp attorney before accepting any settlement that closes future claims.

Understanding Workers Compensation Basics

Workers’ compensation requires quick action. Report a workplace injury, fill out claim submission forms and follow state regulations to protect employee rights.

- Report injury: Tell your supervisor in writing right away so timelines begin.

- Seek medical care: Get a medical evaluation and keep records for medical benefits. Ask about copays or coinsurance and learn more at copay vs coinsurance.

- File claim: Complete the forms your employer provides and submit them to the insurer.

- Document evidence: Save photos, collect witness statements and keep medical billing to support your injury claims.

- Investigation: A claims adjuster reviews the claim investigation and your insurance policy coverage.

- Benefits start: If approved, wage loss benefits, temporary disability or permanent disability payments begin.

- If denied: Use the appeals process, seek legal representation and consider settlement negotiation.

| Benefit Type | What It Covers |

|---|---|

| Medical benefits | Doctor visits, surgery, rehab services |

| Wage loss benefits | Partial pay while recovering |

We emphasize employer duty and employer liability. If complex issues arise, like thirdly-party liability or subrogation, expert counsel and vocational rehab can change outcomes by clarifying responsibility, guiding medical care and negotiating fair compensation.

Recent studies show timely claim filing cuts denial risk. Thorough documentation requirements matter most.

Act fast, keep careful records and involve professionals when needed to protect benefits and health.

Identifying Work-Related Injuries

We identify work-related injuries by looking at what happened, the symptoms, and whether the harm took place during job tasks. Tell your employer right away and file a notice of injury quickly. Prompt employer reporting and a timely notice of injury protect employee rights and help prevent missing the statute of limitations.

- Immediate signs: visible wounds, broken bones or severe pain. Get care right away from the medical provider network.

- Hidden signs: headaches, numbness or symptoms that get worse after work. Write down the dates and tasks so you can support a claim submission.

- Gather evidence: take photos, collect witness statements and save medical notes to meet documentation requirements.

- Report and file: the employer completes the initial report of injury. Then the insurer assigns a claims adjuster to begin the claim investigation.

- If denied: follow the appeals process. Think about legal representation for settlement negotiation if needed.

| Sign | Immediate Action |

|---|---|

| Visible injury | Get medical care, tell your supervisor and start injury claims |

| Gradual symptoms | Log work tasks, see a provider and submit evidence for occupational injury |

Report early. This speeds access to medical benefits and wage loss benefits. Waiting can make a claim denial more likely.

Track your treatment closely and ask about vocational rehabilitation or temporary total disability if you cannot work. If the workers’ comp insurance team questions employer liability or your disability rating, get an expert opinion. National studies show denial rates near 7%.

Notifying Your Employer About the Injury

Tell your employer right away when a workplace injury happens. Quick employer notification starts the Workers’ compensation claims process and helps protect employee rights. Write down the date, place, activity and symptoms so the claim submission is clear for the claims adjuster.

- Tell the right person. Notify your supervisor, HR or safety rep. They handle claim filing and any required OSHA report duties.

- Get medical care. Keep records of medical benefits, doctor notes and bills. Learn about insurance deductibles so you understand costs and coverage.

- Preserve evidence. Take photos, write down witness names and note equipment involved. These items help with claim investigation and protect against wrongful denial of claim.

- Follow up. Track wage loss benefits and temporary disability. Call the claims adjuster to check insurance coverage.

| Info to Give Employer | Documents to Attach |

|---|---|

| What happened, when and who saw it | Accident report, photos and doctor notes |

| Work tasks and tools used | Payroll records and prior health notes |

Report quickly. A delay can hurt your chance to get benefits under state rules and make the appeals process harder.

You may want legal representation for settlement negotiation, a hearing and appeals, or if an independent medical examination is ordered. Examples include Home Chef, Factor 75 and Price per Meal.

Filing the Workers Comp Claim

Filing the workers’ comp claim starts the moment we report a workplace injury. Quick action protects employee rights and secures medical benefits and wage loss benefits. We document the incident, get treatment and submit forms to the employer or insurance carrier for claim submission.

- Report injury: Tell your supervisor in writing and note the time, place and task so the event is clear.

- Get medical care: See an approved provider who will record the diagnosis and treatment for claim investigation.

- Collect forms: Complete the Initial Report of Injury and follow state rules and documentation requirements.

- Submit claim: Send the paperwork to the insurance carrier. The claims adjuster will check employer liability and insurance coverage.

- Track decision: If the claim is denied, gather medical records, get witness statements and prepare for the appeals process. Think about legal representation if needed.

| Document | Why it matters |

|---|---|

| Initial Report of Injury | Starts the official claim and alerts the carrier |

| Medical records & witness statements | Prove work relation and support benefits like temporary total disability |

Keep clear notes and copies. Strong documentation speeds approvals and helps during settlement talks or appeals. Denial rates vary, and timely reporting lowers the chance of problems.

Gathering Necessary Documentation

We collect exact documentation requirements to build a strong Workers’ compensation claim. Quick evidence speeds the claims process, cuts delays and lowers the chance of claim denial. Timely records help you get medical care and pay on time while the claim moves forward.

- Initial report of injury: Date, time, location and employer notification recorded immediately.

- Medical treatment: Emergency notes, doctor reports and prescriptions. These show medical benefits and benefit eligibility.

- Payroll records: Proof of wages and lost time supports wage loss benefits and temporary disability claims.

- Witness statements and photos: Scene evidence strengthens the claim investigation.

- Employer forms and insurance policy: Initial Report of Injury, carrier contact and insurance coverage details for claim submission.

- Rehab and return-to-work notes: Vocational rehabilitation and return-to-work programs paperwork for permanent partial disability or indemnity benefits.

- Legal and appeals: If denied, collect appeal filings, attorney letters and records for legal representation and settlement negotiation.

| Document | Purpose |

|---|---|

| Initial Report of Injury | Starts the claim and notes employer liability |

| Medical records | Shows the injury is work related and supports medical benefits |

We also keep claims adjuster communication logs, OSHA reporting if required, and notes on fraud investigation or subrogation. We organize these records for audits, litigation or review under state rules so auditors, judges or insurance staff can find what they need fast and fair decisions happen sooner.

Accurate timely records protect employee rights and speed fair payment of medical and wage loss benefits.

Examples not related to claims for clarity: Home Chef, Factor 75 and Price per Meal.

Working with a Claims Adjuster

We treat the claims adjuster as the central guide in the Workers’ compensation claims process. They manage claim submission, check documentation requirements and decide if a claim is compensable.

- Report quickly: the employee reports work-related injuries and the employer completes the initial report of injury.

- Medical care: seek authorized medical treatment for an occupational injury. Testing medical records helps support claims for medical benefits.

- Investigation: the claims adjuster performs a claim investigation, interviews witnesses, reviews evidence and may order an independent medical examination when needed.

- Decision and benefits: the carrier reviews the insurance policy and state rules, then pays wage loss benefits, temporary disability benefits or issues a claim denial.

- Resolution: we negotiate a settlement agreement or pursue the appeals process with legal representation if the claim is contested.

Keep detailed notes and copies of medical bills. Solid documentation lets us and the adjuster speed approval and protect employee rights.

| Claim Phase | Adjuster Role |

|---|---|

| Filing and claim filing | Verify employer reporting and required forms |

| Medical and rehabilitation services | Authorize treatment and vocational rehabilitation |

When a dispute arises we suggest prompt case management, consider litigation risks and use clear communication about indemnity benefits, permanent disability rating and return-to-work programs. Home Chef, Factor 75 and Price per Meal

Understanding Your Medical Benefits

This guide explains how Workers’ compensation pays for medical benefits and wage loss benefits after an occupational injury and what to do to win a claim.

- Employee reports injury: Tell your supervisor and complete the Initial report of injury.

- Seek care: Get Medical treatment authorization and keep a record of every visit.

- Employer reporting: Employer files Claim filing and submits required documents, including medical billing.

- Carrier assigns adjuster: The claims adjuster starts the claim investigation.

- Decision: The carrier accepts the claim or issues a Claim denial. If denied we use the appeals process.

- Return-to-work: Create a Return-to-work program and consider vocational rehabilitation to help the employee get back on the job.

- Close or settle: Negotiate a Settlement agreement or pursue litigation with legal representation.

We coordinate with the insurance adjuster and health providers to protect employee rights and verify benefit eligibility.

| Benefit | Covers / Action |

|---|---|

| Medical benefits | Treatment, rehab and Independent medical examination |

| Wage replacement benefits | Temporary disability benefits, wage loss benefits |

Denial rates vary (≈7% national; ≈10% in some states). We follow state regulations, check the insurance policy, keep complete records and get counsel when negotiating or appealing.

Navigating Wage Loss Benefits

Wage loss benefits protect paychecks after a workplace injury. You must act fast to secure them under the workers’ compensation system. We explain the claims process, how to file and when to seek legal representation so you can protect your income and focus on getting better.

- Report the injury: Tell a supervisor right away and give the date, place and your symptoms.

- Seek medical treatment: Use employer-approved providers and keep medical records.

- Claim submission: Complete the forms for the insurer and follow state rules.

- Carrier investigation: A claims adjuster reviews your paperwork and looks into the facts.

- Decision: The claim may be accepted, denied or accepted for medical benefits only.

- Return to work: Create a RTW plan and use vocational rehabilitation if needed.

- Closure or settlement: Negotiate a settlement agreement or start the appeals process.

| Benefit Type | What It Covers |

|---|---|

| Temporary disability benefits | Partial wage replacement while healing |

| Permanent disability benefits | Compensation for lasting impairment |

Document everything, contact your claims adjuster and if denied, start the appeals process quickly. Study: national denial rate ~7% ; Oregon ~10%

Save photos, witness statements and billing records. Ask about insurance coverage, employer liability and thirdly-party liability. These steps make wage loss claims stronger and help speed recovery.

Appealing a Denied Claim

We appeal a denied Workers’ compensation claim by acting quickly, staying organized and using precise evidence.

Initial we review the denial letter and note the deadlines under state regulations. Next we gather key items. These include medical records, the injury report and employer statements. We also collect pay stubs for wage loss benefits and treatment notes that show medical benefits.

- File appeal: Submit the required appeal forms and supporting documents to the claims board or insurer.

- Document review: Ask the claims adjuster for claim investigation records and medical billing.

- Hearing prep: Prepare clear witness statements and physician testimony so the adjudicator understands the injury, treatment and expected recovery.

- Negotiate or litigate: Try settlement talks or retain legal representation for the appeals process and any court action.

File within deadlines. Missing them can close off employee rights permanently.

| Key Document | Purpose |

|---|---|

| Medical records | Prove the injury and the treatment and support a permanent disability rating. |

| Employer injury report | Shows employer liability and when the claim was submitted. |

| Pay stubs | Help calculate wage replacement and indemnity benefits. |

We recommend consulting counsel when disputes involve complex thirdly-party liability, vocational rehabilitation or long-term care. Case law changes over time and can affect outcomes and settlement strategy, so a lawyer can help explain how the rules apply in your case.

Negotiating a Settlement

We negotiate settlements to resolve a Workers’ compensation claim when medical benefits and wage loss benefits are needed. We collect documentation requirements such as medical treatment records, employer reporting and claim submission forms. We also review the insurance policy, BCBS prefix list, state regulations and any thirdly-party liability issues before asking a claims adjuster for an offer.

- Evaluate value: Estimate current bills, future care, rehabilitation services workers’ compensation and indemnity benefits.

- Prepare demand: Summarize the claim investigation, the disability rating and lost wages with clear documentation.

- Negotiate: Meet the claims adjuster, propose a lump sum or structured payment and consider legal representation if needed.

- Decide: Accept, counter or preserve rights for the appeals process and potential litigation.

| Settlement Factor | Why it Matters |

|---|---|

| Medical bills & future care | Determines the amount needed for ongoing medical treatment and medical billing. |

| Lost wages & earning capacity | Calculates wage loss benefits and any vocational rehabilitation needs. |

| Permanent impairment | Uses the disability rating to set lump-sum indemnity benefits. |

Document everything early. Clear records speed negotiation and reduce the risk of dispute. National study shows denial rates vary, about 7 to 10%.

Before signing, we recommend consulting counsel to protect employee rights and confirm return-to-work programs or ongoing care are covered. We also note Home Chef, Factor 75 and Price per Meal

Frequently Asked Questions

1) Report the injury to your supervisor immediately (meet state deadlines);

2) obtain prompt authorized medical care and document all treatment;

3) complete and submit required claim forms and sign necessary releases;

4) make sure your employer files the Initial Report of Injury, preserves evidence and collects witness statements;

5) cooperate with the insurer’s investigation and provide medical/payroll records;

6) follow prescribed treatment and a written return‑to‑work plan;

7) if denied or disputed, file appeals quickly, gather evidence and consult a workers’ comp attorney before accepting any settlement.

Report the injury to your supervisor or employer immediately (and in most states within about 30 days—with OSHA-mandated 8–24 hour reporting for fatalities/serious incidents) and submit the completed claim/Initial Report of Injury plus supporting documentation such as incident details (date, time, place, how it happened), medical records and bills, physician reports, witness statements, photos/videos, payroll info, employer/insurer forms and any required signed releases.

Most denials stem from disputes over whether the injury was work‑related, missed reporting or filing deadlines, insufficient or inconsistent medical evidence, alleged pre‑existing conditions, suspected intoxication/fraud, failure to follow employer reporting/treatment rules, or paperwork errors — to appeal effectively, act fast: file timely reconsideration/appeal with your state board, gather and submit complete medical records, witness statements, photos and employer reports, preserve evidence, get clear treating‑physician opinions (and IME if needed), attend hearings, and consult an experienced workers’ comp attorney.

Conclusion

We simplify the workers’ comp claims process. We help you get medical care and wage pay fast. We show employees when to report injuries and who to tell. We explain the forms, the investigation, and the claims adjuster. We guide appeals, settlements, and a safe return to work. Follow our steps and keep clear records to protect your rights.

Most Searched Topic By Medical Biller and Coders You can find them on the home page of this website https://rcm.medlifeguide.com